The PA gas tax is one of the highest in the nation, and if you’re filling up in Pennsylvania, you’re definitely feeling it at the pump. As of 2024, Pennsylvania’s state excise tax on gasoline sits at 58.7 cents per gallon—a number that adds up fast when you’re commuting, running errands, or taking road trips. Understanding how this tax works, what you’re actually paying, and whether there are legitimate ways to reduce the impact can help you make smarter financial decisions.

Whether you’re a Pennsylvania resident, a business owner with a fleet, or someone who frequently drives through the state, this guide breaks down everything you need to know about PA’s gas tax landscape in 2024.

Table of Contents

Current PA Gas Tax Rates

Let’s start with the hard number: Pennsylvania’s state excise tax on gasoline is 58.7 cents per gallon as of 2024. On top of that, you’re also paying the federal excise tax of 18.4 cents per gallon on gasoline (24.4 cents on diesel). This means every gallon you pump includes roughly 77 cents in combined state and federal taxes before you even factor in sales tax on the transaction itself.

Pennsylvania also taxes diesel at a slightly higher rate—74.1 cents per gallon at the state level. If you drive a diesel vehicle, that difference compounds quickly over the course of a year. For a typical driver filling up twice a week, that’s an extra $30-40 annually just from the diesel differential.

These rates haven’t changed since 2016, when Pennsylvania increased the gas tax as part of a transportation funding initiative. While the rate itself is frozen, the impact on your wallet continues to grow as you fill up more frequently.

How Gas Tax Is Calculated

Understanding the math behind what you pay helps demystify those pump prices. When you see the final price per gallon displayed at the station, here’s what’s baked in:

The breakdown looks like this: Base wholesale cost + state excise tax (58.7¢) + federal excise tax (18.4¢) + retailer markup + sales tax on the total amount. Pennsylvania applies sales tax to the entire transaction, including the taxes themselves—which is why your effective tax burden feels even heavier than the headline numbers suggest.

If you’re buying premium or mid-grade fuel, you’re paying the same per-gallon excise tax as regular unleaded. The tax doesn’t discriminate based on fuel quality; it’s a flat rate regardless of octane level. This is important for budget planning—switching to regular fuel saves you money on the base product cost, but the tax portion stays constant.

For business owners, understanding this calculation matters because fuel expenses are often tax-deductible. We’ll cover that in detail below, but knowing that the excise tax component is embedded in your total fuel cost is the first step toward proper accounting.

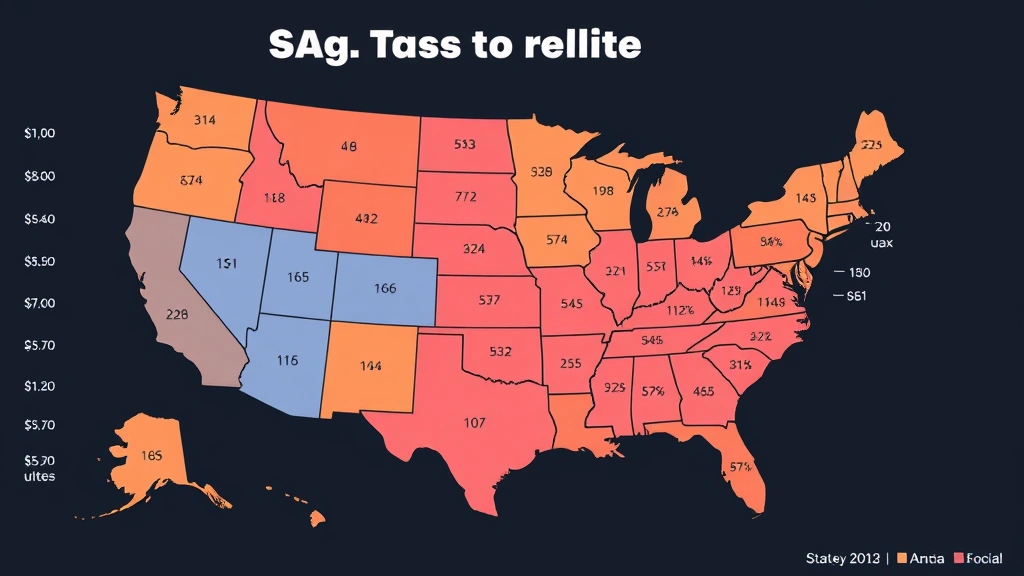

PA vs. Other States Comparison

Pennsylvania ranks among the highest gas-taxing states in America, and the numbers tell the story. Only a handful of states charge more per gallon. California leads at around 68 cents per gallon, while states like Washington, Illinois, and Indiana cluster in the 50-55 cent range. Meanwhile, states like Mississippi, Alaska, and South Carolina sit below 30 cents per gallon.

What makes Pennsylvania’s position interesting is that it’s not the absolute highest, but it’s consistently in the top 10. This matters if you live near state borders—many Pennsylvania residents strategically fill up in nearby states when possible, though the savings are modest and require planning.

The comparison also matters for understanding why Pennsylvania’s roads are generally well-maintained compared to lower-tax states. That gas tax revenue directly funds the Department of Transportation, which manages highway repairs and infrastructure projects. It’s not a perfect correlation, but higher taxes typically mean better-funded road systems.

Why PA Has High Rates

Pennsylvania’s gas tax didn’t get high overnight. The current 58.7-cent rate resulted from a 2016 increase that was part of a broader transportation funding overhaul. Before that increase, the rate was 40.7 cents per gallon—meaning Pennsylvania essentially added 18 cents per gallon in one legislative move.

The reasoning was straightforward: Pennsylvania’s transportation infrastructure needed funding, and the state chose a gas tax increase over other revenue sources like income tax hikes or tolls. The bill that created this increase, Act 89, was designed to generate roughly $2 billion annually for highway, bridge, and public transit projects.

Historically, Pennsylvania has been cautious about raising the gas tax. The previous major increase was in 1997, nearly two decades before 2016. This long gap between increases meant that inflation had eroded the purchasing power of the tax revenue—the same cents-per-gallon amount bought less road maintenance each year.

Understanding this history matters because it shows that Pennsylvania doesn’t raise gas taxes frivolously. When increases do happen, they’re typically tied to specific infrastructure needs. This context helps explain why the 2016 rate has held steady through 2024, despite inflation and changing transportation needs.

Who Actually Pays Gas Tax

On the surface, you pay the gas tax when you fill up. But the economic impact spreads far wider than individual drivers. Here’s who really bears the burden:

Direct payers: You, the driver, pay directly at the pump. Every gallon you purchase includes the tax baked into the final price.

Businesses and fleets: Commercial vehicles, delivery trucks, taxi services, and rideshare drivers pay the tax on every gallon. These costs get passed along to customers through higher prices for goods and services. When your pizza delivery costs more, some of that is gas tax.

Public services: School buses, police vehicles, fire trucks, and other government vehicles pay the tax on fuel. This is essentially taxpayers funding the tax, which creates an interesting circular dynamic.

Indirect payers: Anyone buying goods shipped via truck, taking public transit, or using delivery services pays the gas tax indirectly through higher prices. It’s a hidden tax embedded in the cost of living.

This broad impact is why gas tax policy matters beyond just personal driving. A high gas tax in Pennsylvania makes doing business slightly more expensive, which affects competitiveness for logistics companies and transportation-dependent businesses. Some companies factor Pennsylvania’s gas tax into location decisions when choosing where to establish operations.

Business Deductions & Fuel Expenses

If you’re self-employed, own a business, or use your vehicle for work, the gas tax situation changes significantly because fuel expenses become deductible. This doesn’t eliminate the tax, but it reduces the after-tax cost through the deduction.

Here’s how it works: You can deduct actual fuel expenses (including the gas tax component) using the actual expense method, or you can use the standard mileage deduction, which the IRS sets annually. For 2024, the standard mileage rate for business driving is 67 cents per mile, which includes an implicit allowance for fuel and fuel taxes.

The key distinction: If you use actual expenses, you’re deducting the full amount you paid at the pump, including all taxes. If you use the standard mileage rate, you’re using the IRS’s estimate, which may be higher or lower than your actual costs depending on your driving patterns and local gas prices.

For example, if you drive 10,000 business miles in 2024, the standard mileage deduction would be $6,700. If your actual fuel costs (including PA gas tax) were $3,500, actual expenses would be better. But if actual costs were $7,500, you’d be better off with the standard mileage rate.

This is where proper tax planning strategies come into play. We recommend tracking both methods throughout the year and calculating which gives you the better deduction. For detailed guidance on optimizing your business deductions, our tax planning strategies guide walks through the full process.

Practical Savings Strategies

While you can’t eliminate the PA gas tax, there are legitimate strategies to reduce its impact on your budget:

1. Use fuel rewards programs: Many grocery stores and gas stations offer loyalty programs that discount fuel. These savings stack on top of the base price and can reduce your effective cost by 5-10 cents per gallon over time. It’s not much per gallon, but it adds up.

2. Optimize your driving habits: Better fuel economy means fewer gallons purchased, which directly reduces the total tax you pay. Maintaining proper tire pressure, avoiding excessive idling, and reducing aggressive acceleration can improve MPG by 10-15%.

3. Plan routes strategically: If you live near a state border with lower gas taxes, occasional fill-ups in those states can save money. However, the time and gas spent getting there needs to justify the per-gallon savings. This works better for regular commuters than casual drivers.

4. Track business mileage carefully: If you have any business driving, meticulous mileage logs help you maximize deductions. The gas tax is part of your deductible fuel cost, so better documentation means better tax outcomes.

5. Consider vehicle efficiency: While a major purchase decision, moving to a more fuel-efficient vehicle or electric car reduces gas tax exposure over time. Electric vehicles eliminate gas tax entirely, though they introduce different transportation costs.

For business owners, understanding excise tax mechanics helps with overall tax strategy planning, though the gas tax specifically isn’t paid separately—it’s embedded in fuel purchases.

Future Outlook for PA Gas Tax

The Pennsylvania gas tax rate of 58.7 cents per gallon has remained frozen since 2016, and there’s no indication of imminent change. However, several forces are reshaping the gas tax landscape:

Electric vehicle adoption: As more drivers switch to EVs, gas tax revenue naturally declines. Pennsylvania, like other states, is grappling with how to fund roads when fewer people buy gasoline. Some proposals include vehicle registration fees tied to vehicle weight or EV-specific fees.

Inflation and purchasing power: While the per-gallon rate hasn’t changed, inflation has increased the absolute dollar amount collected. A 2% annual inflation rate means gas tax revenue grows even without a rate increase, but the purchasing power of that revenue for road maintenance doesn’t grow as fast.

Federal infrastructure funding: The 2021 Infrastructure Investment and Jobs Act provided additional federal funding for state transportation projects. This reduced pressure on Pennsylvania to raise gas taxes in the near term, but long-term needs may still require future increases.

Political dynamics: Any gas tax increase faces significant political opposition. Drivers notice pump prices immediately and blame politicians for tax increases. This creates a political disincentive to raise rates, even when infrastructure needs are clear.

For long-term financial planning, assume the current rate will persist through 2025 and beyond, but don’t be shocked if a future increase happens. If you’re making major decisions about vehicle purchases or business location, factoring in potential future gas tax increases is prudent.

Frequently Asked Questions

What is Pennsylvania’s current gas tax rate?

Pennsylvania’s state excise tax on gasoline is 58.7 cents per gallon as of 2024. This is the highest state-level component of the total tax you pay at the pump. When combined with the federal excise tax of 18.4 cents per gallon, you’re paying roughly 77 cents per gallon in combined excise taxes before sales tax.

Is PA gas tax higher than neighboring states?

Yes. Pennsylvania’s 58.7-cent rate is higher than Ohio (38.51¢), West Virginia (35.85¢), and New York (54.75¢). Only a few states like California and Washington have higher rates. If you live near a border, you might save money occasionally filling up in neighboring states, but the savings are modest—typically 3-5 cents per gallon.

Can I deduct gas tax as a business expense?

Yes, if you use your vehicle for business purposes. You can deduct fuel costs (including the gas tax component) using either the actual expense method or the standard mileage deduction. Track your mileage carefully to maximize your deduction. Our tax planning strategies guide provides detailed guidance on choosing the best method for your situation.

When was the last PA gas tax increase?

The most recent increase occurred in 2016, when Pennsylvania raised the gas tax from 40.7 cents to 58.7 cents per gallon. This 18-cent increase was part of Act 89, legislation designed to fund transportation infrastructure. The rate has remained unchanged since then.

What happens to PA gas tax revenue?

Gas tax revenue funds the Pennsylvania Department of Transportation, which manages highway maintenance, bridge repairs, and public transit projects. Roughly $2 billion annually is generated from the current gas tax rate, making it a crucial funding source for infrastructure investment.

Will PA gas tax increase soon?

There’s no indication of an imminent increase. The rate has been frozen for 8 years, and political resistance to gas tax increases remains strong. However, long-term infrastructure needs and declining gas tax revenue as EV adoption grows may eventually require future increases. For now, assume the 58.7-cent rate will persist.

How much does PA gas tax cost annually?

For an average driver filling up 50 times per year (roughly twice weekly) with 12-gallon tanks, the PA gas tax costs approximately $350 annually. For higher-mileage drivers or commercial vehicles, the cost is significantly higher. Business owners should track these expenses carefully for tax deduction purposes.

Final Thoughts on PA Gas Tax

Pennsylvania’s gas tax is a significant cost factor for drivers, businesses, and anyone purchasing goods in the state. At 58.7 cents per gallon, it’s among the nation’s highest and directly impacts your transportation budget. Understanding how the tax works, who really bears the burden, and where legitimate savings opportunities exist helps you make smarter financial decisions.

For individual drivers, the strategies are straightforward: optimize fuel efficiency, use rewards programs, and plan routes intelligently. For business owners, meticulous tracking of fuel expenses and choosing the right deduction method can meaningfully reduce your tax liability. The gas tax component of your fuel costs is deductible, so proper accounting matters.

Looking forward, the current rate appears stable through 2025 and beyond, though long-term infrastructure needs and EV adoption may eventually force changes. For now, budget for the 58.7-cent state tax as a fixed cost of driving in Pennsylvania, and focus on the controllable factors—vehicle efficiency, driving habits, and tax deductions—to minimize the overall impact on your finances.