If you’re buying anything in Michigan, you need to understand what is Michigan sales tax and how it affects your wallet. Michigan’s sales tax system is straightforward on the surface, but it has some quirks that can surprise you at checkout. Whether you’re a resident, a business owner, or just visiting, knowing the ins and outs of Michigan’s sales tax rules will help you budget smarter and avoid unexpected costs.

Table of Contents

Michigan Sales Tax Rate

Michigan’s statewide sales tax rate is 6%. This is one of the lower rates compared to some neighboring states, but it’s not the whole story. The 6% rate applies to most retail purchases across the state, but your actual tax burden depends on where you shop and what you’re buying.

The state has maintained this 6% rate for years, and it’s one of the most predictable aspects of Michigan’s tax system. However, don’t assume that 6% is what you’ll always pay at the register. Some counties and municipalities in Michigan have added local taxes on top of the state rate, which can push your total sales tax significantly higher. This is why understanding the breakdown of Michigan sales tax matters for your budget planning.

How Sales Tax Is Calculated

Sales tax calculation in Michigan is simple math: take the purchase price, multiply it by the applicable tax rate, and add it to your total. If you buy a $100 item in a jurisdiction with only the state 6% rate, you’ll pay $6 in tax. The formula is straightforward, but the tricky part is knowing which rate applies to your specific purchase.

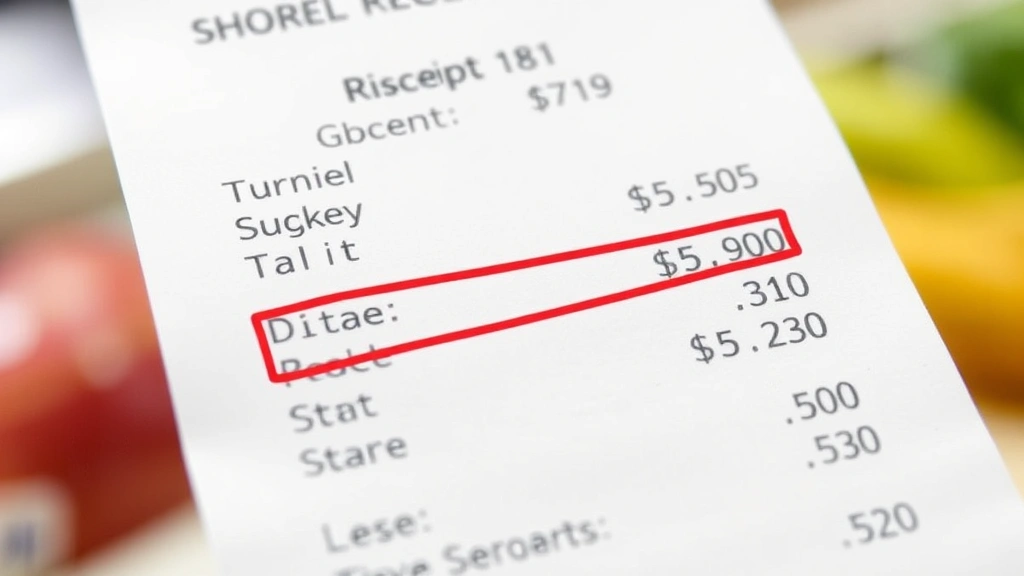

Retailers are responsible for collecting and remitting sales tax to the state. They’re required to display the tax separately on receipts, so you can see exactly how much tax you’re paying. If you’re a business owner, you’ll need to understand these calculations for your own transactions and tax-free shopping events that your customers might take advantage of. The Michigan Department of Treasury provides detailed guidance on how to calculate and report sales tax correctly.

Taxable vs. Nontaxable Items

Not everything you buy in Michigan is subject to sales tax. Understanding what’s taxable and what’s not is crucial for accurate budgeting. Generally, tangible personal property—physical items you can touch and hold—is taxable. This includes clothing, electronics, furniture, and most consumer goods.

However, Michigan has specific exemptions that apply to certain categories. Services are typically not taxable in Michigan, which means you won’t pay sales tax on haircuts, plumbing repairs, or consulting fees. This is a major difference from some states that tax services. Intangible property like digital downloads, software licenses, and streaming subscriptions also generally escape Michigan sales tax, though the rules can be complex depending on how the service is delivered.

The distinction between taxable and nontaxable items matters because it directly affects your final bill. A $200 haircut won’t have tax added, but a $200 jacket will. Understanding these categories helps you plan purchases and avoid surprises at checkout.

Groceries and Food Exemptions

Michigan offers significant relief on grocery purchases—a benefit that helps families manage their food budgets. Most groceries are exempt from sales tax in Michigan. This includes items like bread, milk, vegetables, fruits, meat, and other food staples you’d buy at a supermarket.

However, there’s an important distinction: prepared foods and items consumed on-site are taxable. If you buy a sandwich from a deli counter and eat it there, or grab a hot pizza to go, you’ll pay sales tax. The same applies to restaurant meals. The tax applies to food that’s prepared for immediate consumption, not raw ingredients you’ll cook at home.

This exemption is substantial because groceries represent a significant portion of household spending. Families can save considerably on their food bills by taking advantage of this tax-free status. Just remember to distinguish between grocery store items (tax-free) and prepared foods (taxable). When shopping at stores like Costco or Whole Foods, most items in your cart will be tax-free, but prepared foods in their food courts won’t be.

Clothing and Footwear Rules

Here’s where Michigan differs from some states: clothing and footwear are taxable in Michigan. There’s no special exemption for apparel, unlike in states like Pennsylvania or New Jersey. Whether you’re buying a $15 t-shirt or a $500 winter coat, you’ll pay the full sales tax on it.

This applies to all clothing items: shirts, pants, dresses, jackets, hats, gloves, and shoes. Even accessories like belts and scarves are taxable. If you’re budgeting for a back-to-school shopping trip or updating your winter wardrobe, remember to factor in the 6% (plus any local taxes) on all apparel purchases.

The only exception is clothing used for a specific occupational purpose, like uniforms or protective gear required for work. But everyday clothing, no matter how expensive, will have sales tax applied. This is one of the key differences between Michigan and neighboring states, so if you’re near a border, it’s worth noting.

Services and Labor Charges

Michigan generally does not tax services, which is a significant advantage for consumers. When you hire a plumber, electrician, accountant, or any service professional, you won’t pay sales tax on their labor charges. This applies to a wide range of services: haircuts, dental work, car repairs, home renovations, and professional consulting.

However, there’s an important caveat: if the service involves selling tangible goods along with the service, the goods portion may be taxable. For example, when a mechanic repairs your car and installs new parts, the labor isn’t taxed, but the parts themselves might be subject to tax depending on how they’re classified. It’s a nuanced area, and the Michigan Department of Treasury provides guidance for specific situations.

Understanding this distinction helps you budget for major service expenses. A $1,000 home repair project’s cost is the full $1,000 if it’s primarily labor. But if it includes $300 in materials, those materials might be taxable. Always ask your service provider for a detailed breakdown so you know what you’re paying for.

Local Tax Variations Across Michigan

While Michigan’s state sales tax is 6%, some counties and municipalities have added local sales taxes on top of this rate. This means your actual sales tax rate depends on where you shop. In some areas, you might pay 6%, while in others, you could pay 7%, 8%, or even higher.

The local additions typically range from 0.5% to 2% above the state rate. Cities like Detroit have their own local tax considerations. If you shop in different parts of Michigan regularly, you’ll notice these variations. A purchase that costs $106 in one county might cost $107 or more in another county due to local taxes.

This is why it’s important to know your local rate. When comparing prices between online retailers and brick-and-mortar stores, factor in your local tax rate. Also, if you’re near a state border, you might want to check the rates in neighboring states like Indiana or Ohio, which can have different tax structures. Check the Michigan Department of Treasury website for the most current local tax rates in your area.

Online Shopping and Sales Tax

The online sales tax landscape changed significantly with recent court rulings. Michigan now requires most online retailers to collect and remit sales tax on purchases shipped to Michigan residents, even if the retailer doesn’t have a physical presence in the state. This means that Amazon, Walmart.com, and most other major online retailers charge Michigan sales tax on orders.

However, not all online sellers comply with this requirement. Smaller retailers and international sellers may not collect Michigan sales tax. If you purchase from an out-of-state seller who doesn’t collect tax, you’re technically responsible for paying “use tax”—essentially the same as sales tax—when you file your state income tax return. Most people don’t report this, but it’s the law.

For practical purposes, assume you’ll pay sales tax on most online purchases from major retailers. The tax is calculated based on your delivery address, so you’ll pay your local rate plus the state rate. This makes online shopping less of a tax advantage than it used to be, so price comparisons between online and in-store should account for this.

Business Resale Certificates

If you own a business that resells products, Michigan allows you to purchase inventory without paying sales tax by providing a resale certificate. This is crucial for retailers, wholesalers, and anyone who buys products to resell to customers. Without this certificate, you’d pay tax on your inventory purchases, and then your customers would pay tax again when they buy from you—double taxation.

A resale certificate (also called a reseller’s permit) exempts you from paying sales tax on purchases intended for resale. You’ll need to register with the Michigan Department of Treasury and provide your resale certificate number to suppliers. The certificate must be renewed periodically, and you’re required to keep detailed records of all tax-exempt purchases.

If you’re starting a retail business, getting a resale certificate should be one of your first steps. It directly impacts your cash flow because you’re not paying tax on inventory. Just remember that you’re responsible for collecting and remitting sales tax from your customers, so this isn’t a tax break—it’s a mechanism to prevent double taxation.

Frequently Asked Questions

Is Michigan sales tax 6% everywhere in the state?

The state rate is 6%, but many counties and cities have added local taxes. Your actual rate depends on your location. Check with your local tax assessor or the Michigan Department of Treasury for your specific area’s rate.

Do I pay sales tax on groceries in Michigan?

Most groceries are exempt from sales tax in Michigan. However, prepared foods, restaurant meals, and items consumed on-site are taxable. Raw ingredients and shelf-stable grocery items are generally tax-free.

Are clothes taxable in Michigan?

Yes, all clothing and footwear are subject to Michigan sales tax. Unlike some states, Michigan doesn’t offer a clothing exemption. This applies to all apparel purchases, regardless of price.

Do I need to pay sales tax on online purchases?

Most major online retailers now collect Michigan sales tax on orders shipped to the state. Your local tax rate applies based on your delivery address. Smaller sellers may not collect tax, but you’re technically responsible for use tax in those cases.

What services are taxable in Michigan?

Most services are not taxable in Michigan. This includes labor for repairs, professional services, and personal services like haircuts. However, if tangible goods are included with the service, those goods may be taxable.

How do I find my local sales tax rate?

Visit the Michigan Department of Treasury website and use their tax rate lookup tool. You can search by county or city to find your exact combined state and local rate.

What’s a resale certificate and do I need one?

A resale certificate exempts businesses from paying sales tax on inventory purchased for resale. If you own a retail business, you’ll need to register for one with the Michigan Department of Treasury to avoid paying tax on your inventory purchases.

Final Thoughts on Michigan Sales Tax

Understanding Michigan’s sales tax system doesn’t require a degree in accounting. The 6% state rate is simple, but the exemptions, local variations, and special rules make it worth learning the details. Whether you’re a consumer trying to budget accurately or a business owner managing inventory and customer taxes, knowing what is Michigan sales tax and how it applies to your situation saves you money and keeps you compliant.

The key takeaways: groceries are tax-free, clothing is taxed, services usually aren’t, and your local rate might be higher than 6%. Check your specific location’s rate, understand which items are exempt, and you’ll navigate Michigan’s sales tax system confidently. For the most current information, always reference the Michigan Department of Treasury website or consult with a tax professional if you have complex questions.