Knowing how to find average tax rate is one of the most practical skills you can develop as a taxpayer. Your average tax rate tells you what percentage of your total income actually goes to federal taxes—and it’s different from your marginal rate, which confuses a lot of people. Whether you’re evaluating a job offer, planning retirement, or just curious about what you’re really paying, understanding this number gives you real control over your financial picture.

Table of Contents

- What Is Average Tax Rate?

- Average vs. Marginal Tax Rate

- Step 1: Gather Your Tax Documents

- Step 2: Find Your Taxable Income

- Step 3: Locate Your Total Tax Owed

- Step 4: Perform the Calculation

- Step 5: Interpret Your Results

- Real-World Example Walkthrough

- Common Calculation Mistakes

- Frequently Asked Questions

- Key Takeaways

What Is Average Tax Rate?

Your average tax rate is the total amount of federal income tax you owe divided by your total taxable income, expressed as a percentage. It’s the simplest way to answer the question: “What percentage of my paycheck goes to the IRS?”

For example, if you earned $60,000 and owed $7,500 in federal taxes, your average tax rate would be 12.5%. That’s it. No complicated formulas—just basic division.

This matters because it gives you a realistic picture of your tax burden. Many people think they’re in a “22% tax bracket” and assume they pay 22% on all their income. Wrong. That’s your marginal rate—the rate on your last dollar earned. Your actual average rate is almost always lower, thanks to the progressive tax system.

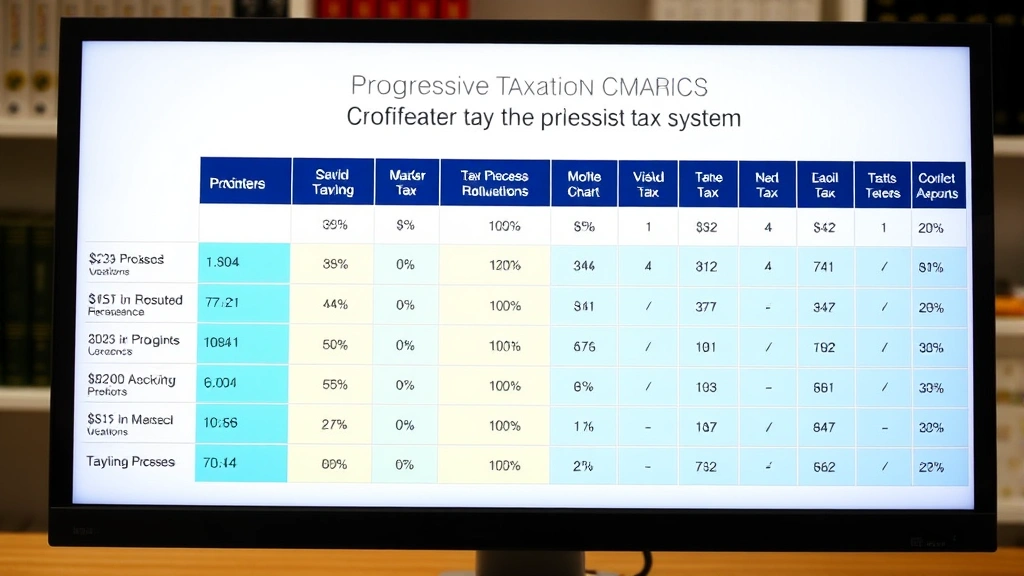

Average vs. Marginal Tax Rate

Here’s where most people get confused, and I see this mistake constantly in client conversations.

Marginal tax rate: The tax rate on your next dollar of income. In 2024, if you’re single and earn between $47,150 and $100,525, your marginal rate is 22%. But that doesn’t mean all your income is taxed at 22%.

Average tax rate: What percentage of your total income goes to taxes. This is always lower than your marginal rate because of tax brackets.

Why does this matter? When you’re evaluating a $5,000 raise, you can’t just multiply it by your marginal rate to figure out what you’ll take home. You also can’t assume your entire income is taxed at the highest bracket you touch. Your average tax rate gives you the real picture.

Think of it this way: the U.S. tax system is like a staircase. Your first dollars climb the lowest steps (10% bracket), then higher dollars climb higher steps (12%, 22%, etc.). Your marginal rate is what step you’re currently on. Your average rate is the average height of all the steps you’ve climbed.

Step 1: Gather Your Tax Documents

Before you calculate anything, pull together the right paperwork. You’ll need:

- Your most recent tax return (Form 1040): This is your starting point. You can find this on the IRS website if you filed electronically, or check your email/files if you printed it.

- Your W-2 or 1099 forms: These show your gross income from employers or self-employment.

- Schedule C (if self-employed): Shows your business income and deductions.

- Schedule 1: This form lists additional income sources like rental income, capital gains, or side gigs.

- Any K-1 forms: If you’re a partner in an LLC or S-corp, you’ll need these.

Most people can skip the fancy documents and just use their 1040. That’s the main event.

Step 2: Find Your Taxable Income

Now comes the critical part: finding your actual taxable income. This is NOT your gross income. It’s what’s left after deductions.

On your Form 1040, look for the line labeled “Taxable Income.” It’s usually near the bottom of the first page. That’s your number.

If you can’t find it, here’s the path:

- Start with your Adjusted Gross Income (AGI)—this is on line 11 of your 1040.

- Subtract your standard deduction (or itemized deductions if you itemized). For 2024, the standard deduction is $14,600 for single filers and $29,200 for married filing jointly.

- The result is your taxable income.

This is where pre-tax contributions like 401(k) and HSA deductions matter—they reduce your AGI, which reduces your taxable income, which reduces your tax bill.

Step 3: Locate Your Total Tax Owed

Find the line on your Form 1040 labeled “Total Tax.” This is your federal income tax liability—the actual amount you owe before credits.

Be careful here: don’t confuse this with:

- Taxes withheld: This is what your employer already took from your paycheck. It’s not what you owe; it’s a prepayment.

- Self-employment tax: If you’re self-employed, this is separate from income tax. For this calculation, we’re only looking at federal income tax.

- Tax credits: The total tax line is before credits, which is what we want.

Your total tax line is exactly what you need. Circle it. Memorize it. This is the numerator in your calculation.

Step 4: Perform the Calculation

Here’s the formula—and it’s beautifully simple:

Average Tax Rate = (Total Federal Income Tax ÷ Taxable Income) × 100

That’s it. Three numbers. One division. One multiplication.

Example:

- Total Federal Income Tax: $12,000

- Taxable Income: $75,000

- Calculation: ($12,000 ÷ $75,000) × 100 = 16%

Your average tax rate is 16%.

You can also calculate this based on gross income if you prefer (using your W-2 wages instead of taxable income), but the IRS and most financial professionals use taxable income. Stick with that for consistency.

Step 5: Interpret Your Results

Now that you have your number, what does it mean?

First, compare it to your marginal rate. If you’re in the 22% bracket but your average rate is 14%, that’s normal and expected. The difference is the benefit of the progressive tax system.

Second, use it as a benchmark. If you’re considering a new job or negotiating a raise, apply your average tax rate to the new income to estimate your after-tax increase. It’s more accurate than using your marginal rate.

Third, track it year to year. If your average tax rate jumps significantly, it might signal that you need to adjust withholding, increase retirement contributions, or reconsider your tax strategy.

For context: the average federal tax rate for all taxpayers in the U.S. hovers around 13-14%. If you’re significantly higher, it might be worth exploring tax-efficient strategies in your state.

Real-World Example Walkthrough

Let’s walk through a complete example to make this concrete.

Meet Sarah: Single, earns $95,000 from her job, has $3,500 in capital gains, and takes the standard deduction.

Her 1040 shows:

- W-2 wages: $95,000

- Capital gains: $3,500

- AGI: $98,500

- Standard deduction: $14,600

- Taxable income: $83,900

- Total federal income tax: $10,880

Her calculation:

($10,880 ÷ $83,900) × 100 = 12.97%

Sarah’s average tax rate is approximately 13%. Even though she’s in the 22% marginal bracket (her last dollar is taxed at 22%), her average rate is 13% because earlier dollars were taxed at lower rates (10%, 12%).

If Sarah gets a $5,000 raise, she shouldn’t assume she’ll lose $1,100 of it to taxes (22% × $5,000). She’ll lose closer to $650 (13% × $5,000), because that raise will be taxed at her marginal rate (22%), but her average rate tells her the real burden across her whole income picture.

Common Calculation Mistakes

I’ve reviewed hundreds of tax calculations, and these errors show up constantly:

Mistake 1: Using gross income instead of taxable income. Your W-2 wages are not the same as taxable income. You must subtract deductions first. Using gross income will overstate your average rate.

Mistake 2: Including self-employment tax. If you’re self-employed, separate your federal income tax from your self-employment tax. They’re calculated differently, and withholding works differently for each. For average tax rate, use only federal income tax.

Mistake 3: Confusing tax withheld with tax owed. Your paycheck stub shows taxes withheld. Your tax return shows taxes owed. These are different. Use taxes owed for this calculation.

Mistake 4: Using refund as a proxy for tax rate. A big refund doesn’t mean you have a low tax rate—it means you overwitheld. Your refund is your own money coming back. Focus on the actual tax owed, not the refund.

Mistake 5: Forgetting about tax credits. The “Total Tax” line on your 1040 is after credits. Use this number, not the tax before credits. Credits are real money back, and they matter.

Frequently Asked Questions

Is average tax rate the same as effective tax rate?

Yes. “Average tax rate” and “effective tax rate” are used interchangeably. They mean the same thing: total tax divided by total income.

What’s a “good” average tax rate?

There’s no universal “good” rate—it depends on your income level and state. Nationally, the average hovers around 13-14%. Higher earners pay higher rates due to the progressive system. If you’re curious whether yours is reasonable, compare it to the IRS tax tables for your income bracket.

Can I calculate average tax rate on just state taxes?

Absolutely. Use the same formula with your state income tax instead of federal. State average rates vary wildly—from 0% in states like Texas and Florida to over 10% in states like California and New York.

Why is my average tax rate lower than my marginal rate?

Because the U.S. uses a progressive tax system. Your first dollars are taxed at lower rates, and only your highest dollars hit your marginal rate. Your average rate reflects the blend of all these brackets.

Should I use average tax rate or marginal rate for financial planning?

Use marginal rate to estimate taxes on new income (a raise, bonus, or investment gain). Use average rate to understand your overall tax burden. Both matter, but for different purposes.

Does my average tax rate include capital gains taxes?

Yes, if you had capital gains or losses in the year you’re calculating. They’re included in your taxable income and total tax on your 1040, so they’re part of your average rate calculation.

How often should I recalculate my average tax rate?

Once a year after you file your taxes. It’s a useful annual checkup. If your life changes significantly (big raise, marriage, business income), you might want to estimate it mid-year to adjust withholding.

Key Takeaways

Finding your average tax rate is straightforward once you know where to look:

- Average tax rate = Total federal income tax ÷ Taxable income × 100. That’s the whole formula.

- Use your tax return. Your Form 1040 has both numbers you need. No guessing required.

- It’s always lower than your marginal rate. This is normal and expected, thanks to tax brackets.

- It’s different from taxes withheld. Withholding is what your employer took. Tax owed is what you actually owe. Use tax owed.

- Use it for planning. When evaluating raises, bonuses, or financial decisions, your average rate gives you a realistic picture of your tax burden.

The beauty of understanding your average tax rate is that it removes the mystery from taxes. You’re not guessing anymore. You’re not assuming your entire paycheck is taxed at your bracket. You know exactly what percentage of your income goes to federal taxes, and that knowledge is power when you’re making financial decisions.