If you live in or own property in Rabun County tax territory, you’re probably wondering how to keep more money in your pocket. Whether you’re dealing with property taxes, income taxes, or sales taxes in this North Georgia mountain community, understanding the local tax landscape is your first step toward real savings. Let me walk you through what you need to know.

Table of Contents

Property Tax Basics in Rabun

Rabun County’s property tax system affects both residential and commercial property owners. The county tax assessor determines your property’s assessed value, which directly impacts what you’ll owe annually. Unlike some states, Georgia doesn’t have a state property tax—it’s purely county-based, which means your Rabun County tax bill depends on local millage rates.

The millage rate in Rabun County typically hovers around 18-20 mills per dollar of assessed value, though this can shift year to year. If your home is assessed at $200,000 and the millage rate is 19 mills, you’re looking at roughly $3,800 in annual property taxes. That’s why understanding assessment is critical—even a $10,000 difference in assessed value saves you about $190 per year.

Property taxes fund essential services: schools, fire departments, roads, and county administration. It’s not wasted money, but that doesn’t mean you should overpay. Many property owners in Rabun County don’t realize they have legitimate ways to reduce their tax burden.

How Property Assessment Works

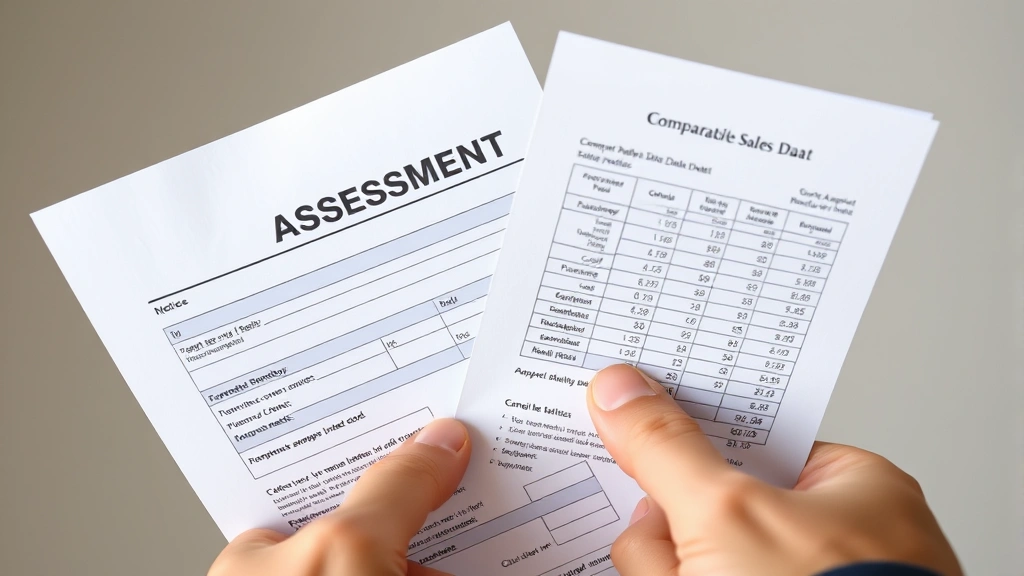

The Rabun County Tax Assessor’s office conducts periodic reassessments to determine fair market value. They use comparable sales data, property condition, square footage, and land value to arrive at an assessed value. Here’s the thing: assessments aren’t always accurate, and errors happen more often than you’d think.

Your assessed value should reflect what your property would sell for on the open market. If comparable homes in your neighborhood sold for $180,000 but yours is assessed at $220,000, you have grounds for an appeal. The assessor uses sales data from the past 12-24 months, so if your neighborhood has cooled off, your assessment might be outdated.

You can request your property’s assessment record from the Tax Assessor’s office. Review the details: square footage, lot size, number of bedrooms and bathrooms, roof condition, and any improvements noted. Mistakes happen—I’ve seen properties listed with an extra bedroom or garage that don’t actually exist. Catching these errors is free money in your pocket.

Homestead Exemptions & Deductions

Georgia offers a homestead exemption that’s genuinely valuable. If your primary residence is in Rabun County, you can claim an exemption that reduces your assessed value by $25,000 for school tax purposes. That’s a $475 annual savings at the typical millage rate—and it’s automatic if you qualify.

You must own the home and live there as your principal residence. You can’t claim it on rental properties or vacation homes. The application is straightforward and handled through the Tax Assessor’s office. If you’ve owned your home for years and haven’t claimed this exemption, you can apply retroactively for the past four years.

Additionally, Georgia offers exemptions for seniors (age 65+), disabled persons, and disabled veterans. These can provide even deeper reductions. A disabled veteran, for example, might qualify for a complete exemption on their primary residence if their disability is service-connected. Don’t assume you don’t qualify—check with the assessor’s office about your specific situation.

Sales Tax Rates Explained

Rabun County’s combined sales tax rate is 7.5%, which includes Georgia’s state rate of 4% plus the local rate. This applies to most retail purchases, though groceries and prescription medications are exempt. It’s not something you can avoid, but understanding it helps you budget accurately.

If you’re a business owner in Rabun County, you need to register for a sales tax permit and remit taxes monthly or quarterly, depending on your volume. The GA TAVT Tax Calculator can help you estimate your obligations. Many small business owners underestimate their sales tax liability, which creates problems come tax time.

One often-missed opportunity: if you’re purchasing items for business use (not resale), you might be exempt from sales tax with a resale certificate. This applies to inventory, equipment, and supplies. Keep detailed records of these purchases—they’re deductible on your business tax return.

Georgia Income Tax Considerations

Georgia’s income tax rate ranges from 1% to 5.75%, depending on your bracket. While Rabun County doesn’t add a local income tax, your Georgia state income tax is unavoidable if you earn income in the state. However, there are legitimate strategies to minimize it.

If you’re self-employed or a business owner, you can deduct business expenses, home office costs, vehicle mileage, and health insurance premiums. Many Rabun County residents leave money on the table by not tracking these deductions. Keep receipts, mileage logs, and expense records throughout the year. The difference between a disorganized business and an organized one can be thousands in tax savings.

Consider whether a retirement account makes sense for your situation. If you’re self-employed, a SEP-IRA or Solo 401(k) allows you to contribute substantial amounts pre-tax, reducing your Georgia income tax liability. For employees, maximizing 401(k) contributions lowers your taxable income. These aren’t tax avoidance schemes—they’re tax planning strategies Congress designed to encourage saving.

Agricultural Property Exemptions

If you own agricultural land in Rabun County, you may qualify for special use valuation. Instead of being assessed at fair market value (which could be high if developers are interested), agricultural property can be assessed based on its agricultural use value. This can reduce your tax bill dramatically.

To qualify, your property must be actively used for farming, forestry, or other agricultural purposes. You typically need at least 10 acres, though there are exceptions for certain operations. The application requires documentation of your agricultural activity: crop sales, livestock records, or timber harvesting logs.

The catch: if you sell the property for non-agricultural use within 10 years of applying for the exemption, you’ll owe back taxes plus interest. It’s not a scam—it’s a legitimate tool for preserving farmland. If you plan to keep your property in agriculture, it’s worth exploring. Compare your current assessment to what the agricultural use value would be; the difference might surprise you.

Tax Payment Methods & Deadlines

Rabun County property taxes are typically due by December 20th of the tax year. If you have a mortgage, your lender likely escrows taxes and insurance, so you don’t pay directly. However, it’s your responsibility to ensure taxes are paid on time.

You can pay online through the Rabun County Tax Collector’s office, by mail, or in person. Paying online is fastest and provides immediate confirmation. Late payments incur a 10% penalty plus interest, so mark your calendar. If you’re facing financial hardship, contact the Tax Collector about payment plans—many counties are willing to work with taxpayers.

For business owners remitting sales tax, the deadline is typically the 20th of the following month. Missing these deadlines triggers penalties quickly. If you’re struggling with cash flow, consider setting aside sales tax as you collect it rather than spending it. I’ve seen too many small business owners caught off guard when the bill comes due.

Challenging Your Tax Assessment

If you believe your Rabun County tax assessment is incorrect, you have the right to appeal. The process is straightforward and costs nothing. You have until the deadline (typically mid-year) to file a Notice of Objection with the Tax Assessor.

To build a strong appeal, gather evidence: comparable sales of similar properties in your area, recent appraisals, photos of your property’s condition, and any documentation of damage or defects. If your home has structural issues, outdated systems, or deferred maintenance, these justify a lower assessment. The assessor’s office should have considered these factors, but sometimes they don’t.

If you disagree with the assessor’s response, you can appeal to the Board of Equalization. This is a local board that reviews assessment disputes. You can present your evidence in person or submit it in writing. Many property owners win appeals simply by showing up with comparable sales data—the board recognizes that assessments aren’t always perfect.

For significant discrepancies, hiring an appraiser or tax professional might make sense. If your assessment is $50,000 too high and an appraiser costs $500, that investment pays for itself in one year of reduced taxes. It’s a legitimate business expense if you’re a business property owner, or simply a smart financial move for residential properties.

Frequently Asked Questions

What’s the difference between assessed value and market value?

Assessed value is what the county determines your property is worth for tax purposes. Market value is what it would actually sell for. They should be close, but they’re not always the same. Market value is typically determined by recent comparable sales; assessed value is set by the assessor and may lag behind market changes.

Can I deduct property taxes on my federal return?

Yes, if you itemize deductions. The SALT (State and Local Tax) deduction is capped at $10,000 per year, which includes property taxes, income taxes, and sales taxes combined. If your Rabun County property taxes exceed $10,000 annually, you can only deduct $10,000 total of state and local taxes. Most homeowners benefit from itemizing if their total SALT plus mortgage interest exceeds the standard deduction.

How often does Rabun County reassess property?

Rabun County conducts reassessments periodically, typically every 4-6 years. However, properties can be reassessed more frequently if there’s been a sale or significant improvement. You should receive notice before a reassessment. If you think your property was recently assessed incorrectly, don’t wait—file an appeal within the deadline.

What happens if I don’t pay my property taxes?

The county can place a tax lien on your property, which means they have a legal claim against it. If taxes remain unpaid, the property can be sold at a tax sale to recover the debt. This is serious—don’t ignore tax bills. If you’re struggling, contact the Tax Collector immediately about options.

Are there senior tax breaks in Rabun County?

Yes. Georgia offers a homestead exemption for seniors age 65 and older, which can provide significant relief. Additionally, some seniors qualify for freezes on their assessed values, meaning taxes won’t increase even if property values rise. Check with the Tax Assessor’s office about your eligibility.

Can I appeal my assessment more than once?

Yes, you can appeal annually if you believe your assessment remains incorrect. However, the burden is on you to provide new evidence each year. If comparable sales have changed, property conditions have deteriorated, or errors have been discovered, a new appeal is justified. Don’t give up after one rejection.

Final Thoughts on Rabun County Tax Planning

Dealing with Rabun County tax obligations doesn’t have to be stressful. Most of the strategies I’ve covered—claiming homestead exemptions, reviewing your assessment, understanding sales tax, and maximizing business deductions—are straightforward and available to everyone. The key is taking action rather than assuming your tax bill is set in stone.

Start by getting a copy of your property assessment and comparing it to recent comparable sales. Check whether you’re claiming all available exemptions. If you’re a business owner, audit your deductions to ensure you’re not leaving money on the table. These steps take a few hours but can save you thousands annually.

If you own property in neighboring counties, understand how their tax systems compare. For context, Cherokee County GA property tax rates and assessment practices may differ from Rabun’s. Similarly, if you’re comparing Georgia to other states, Maui real estate taxes operate under completely different rules.

For more detailed information on Georgia’s tax system, visit the Georgia Department of Revenue website or consult the IRS website for federal tax guidance. If your situation is complex—multiple properties, business income, or significant assets—consider working with a CPA or tax professional familiar with Rabun County. The consultation fee is often recouped through tax savings in the first year.

Remember, paying your fair share of taxes is a civic responsibility. But paying more than you owe is just leaving money on the table. Take control of your Rabun County tax situation, and you’ll sleep better knowing you’re optimizing your finances.