When you’re buying a car in Arizona, sales tax car Arizona is one of those hidden costs that can catch you off guard at the dealership. Unlike some states, Arizona doesn’t mess around when it comes to vehicle purchases—you’ll owe sales tax on the full purchase price, and it’s not optional. But here’s the good news: understanding how Arizona’s auto sales tax works puts you in the driver’s seat to make smarter financial decisions and potentially save thousands of dollars.

Table of Contents

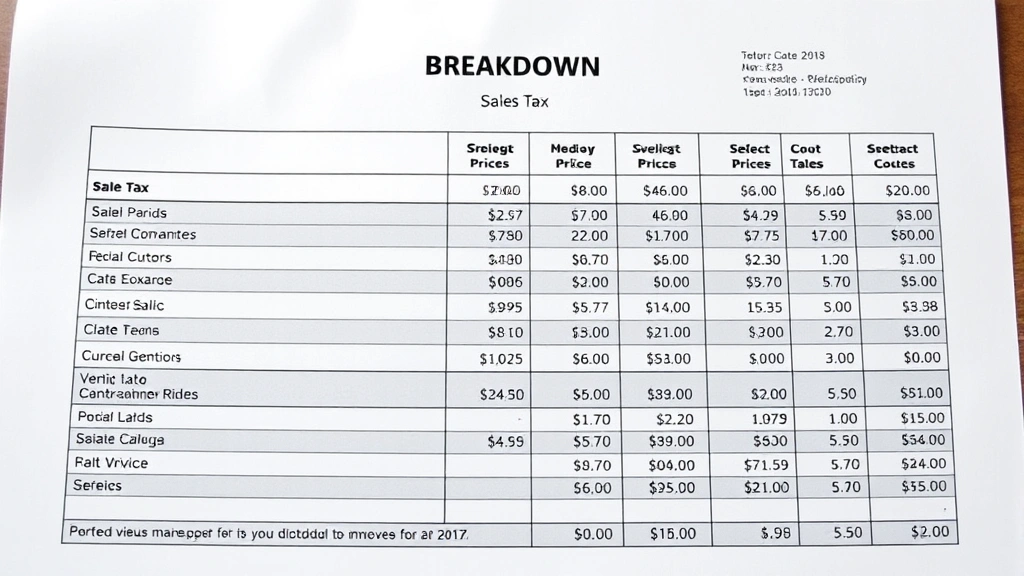

Arizona Sales Tax Rate Breakdown

Arizona’s statewide sales tax rate sits at 5.6%, but don’t let that simple number fool you. When you buy a vehicle in Arizona, you’re actually paying a combined rate that includes state tax plus local county and city taxes. The total rate can range anywhere from 7.6% to 10.725% depending on where you live in the state.

Here’s what makes it complicated: Maricopa County (home to Phoenix) has different rates than Pima County (Tucson), and smaller counties have their own structures too. A $30,000 car purchase in Phoenix might cost you $2,280 in sales tax, while the same car in Tucson could be $2,100. That’s a $180 difference just based on location.

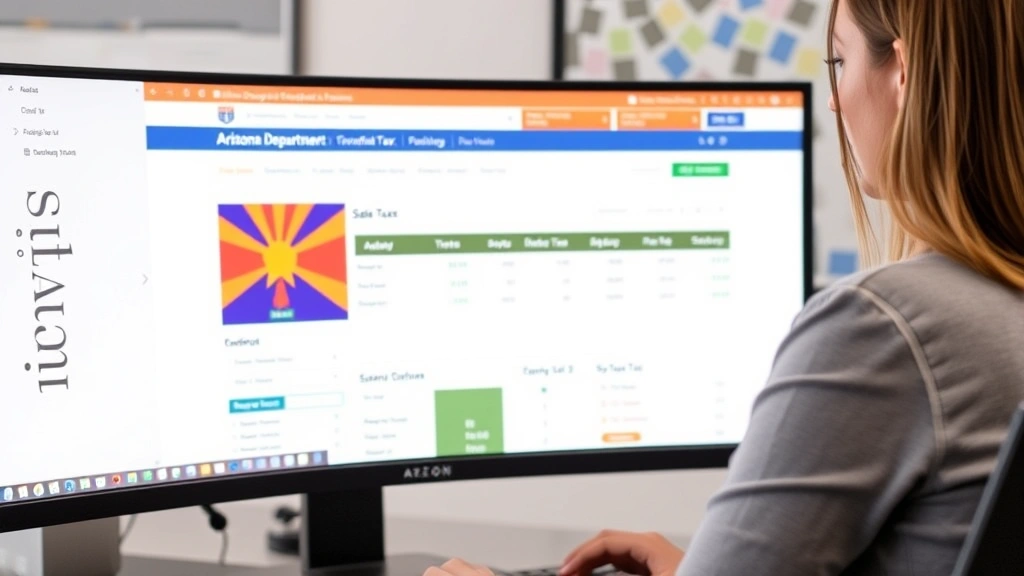

The Arizona Department of Revenue publishes these rates annually, and they’re broken down by county. If you’re shopping for a vehicle, knowing your specific local rate is step one. Don’t assume you know the total—call your county assessor’s office or check the Arizona Department of Revenue website for your exact combined rate.

How Your Car Tax Gets Calculated

The math seems straightforward until you dig into the details. Sales tax is calculated on the net purchase price of the vehicle. Here’s the formula:

Net Purchase Price × Local Sales Tax Rate = Sales Tax Owed

But what counts as the “net purchase price”? This is where most people get confused. If you’re buying from a dealership and trading in your old car, the dealership will subtract your trade-in value from the purchase price before calculating tax. So if you buy a $35,000 car and trade in a vehicle worth $10,000, you only pay tax on $25,000.

This is why dealers love highlighting your trade-in value—it genuinely reduces your tax burden. However, if you’re selling your old car privately and using that cash separately, you’ll pay the full sales tax on the new purchase price.

For private party sales (buying from an individual), Arizona still requires you to pay sales tax based on the agreed purchase price. Many people mistakenly think private sales are tax-free—they’re not.

Trade-In Vehicles and Tax Credits

Arizona’s trade-in tax credit is one of the few ways the state actually helps you save money on a vehicle purchase. When you trade in a vehicle toward a new purchase, you get a dollar-for-dollar reduction on your taxable purchase price.

Let’s work through a real example: You’re buying a 2024 Honda Civic for $28,500 and trading in your 2018 Toyota Corolla valued at $12,000. The dealership will calculate your taxable amount as $16,500 ($28,500 – $12,000). If your local tax rate is 8.6%, you’d owe $1,419 in sales tax instead of $2,451. That’s a $1,032 savings just from the trade-in credit.

The key here is getting an accurate trade-in value. Don’t accept the dealership’s first offer without checking Kelley Blue Book or NADA Guides. A $2,000 difference in your trade-in value directly translates to $172 in extra taxes (at an 8.6% rate). That negotiation matters.

Private Party Car Sales

Buying a car from a private individual doesn’t exempt you from Arizona sales tax—it just changes who collects it. When you purchase a vehicle from another person, you’re responsible for reporting the sale and paying the tax to Arizona.

Here’s how it typically works: You complete the purchase, then take your bill of sale and title documents to your county assessor’s office or the Motor Vehicle Division. You’ll pay the sales tax at that time based on the purchase price you agreed to with the seller.

This is where some people get creative (and where the state gets strict). If you underreport the purchase price to reduce your tax bill, you’re committing tax fraud. Arizona’s Department of Revenue has gotten better at catching these schemes, especially when the reported price is significantly below market value for that vehicle model and year.

The honest approach? Report the actual price you paid. It protects you legally and keeps your conscience clear. Plus, the tax savings from underreporting usually amount to a few hundred dollars—not worth the legal risk.

Registration and Additional Fees

Sales tax is just one piece of the puzzle when you buy a car in Arizona. You’ll also owe registration fees, which are separate from sales tax.

Arizona registration fees are based on the vehicle’s age and weight. A new vehicle typically costs around $160-$180 to register for the first year, while older vehicles cost less. You’ll also pay a $4 title transfer fee and potentially an $8 registration plate fee. These aren’t huge amounts individually, but they add up.

If you’re financing the vehicle, your lender will require you to have comprehensive and collision insurance before they’ll release the funds. This isn’t a government fee, but it’s a cost you need to budget for. Compare quotes from multiple insurers—shopping around can save you $500+ annually on premiums.

Some dealerships also charge documentation fees (sometimes called “doc fees” or “admin fees”), which can range from $50 to $300. These are negotiable. Don’t just accept whatever the dealership puts on the paperwork—ask if they can reduce or eliminate this fee, especially if you’re a well-qualified buyer.

Smart Ways to Save Money

Now that you understand how Arizona’s auto sales tax works, here are concrete strategies to reduce your total cost:

1. Negotiate the Purchase Price First

Every dollar you reduce the purchase price saves you approximately 8-10 cents in sales tax (depending on your local rate). Spend time negotiating the vehicle price before discussing your trade-in. This gives you leverage and clarity on what you’re actually paying.

2. Maximize Your Trade-In Value

Get your trade-in vehicle detailed and in the best condition possible before trading it in. Research comparable vehicles online. A $1,000 difference in trade-in value saves you roughly $80-$100 in sales tax. That’s free money if you negotiate better.

3. Time Your Purchase Strategically

Arizona doesn’t offer sales tax holidays for vehicles like some states do for back-to-school items, but buying at the end of the month or quarter when dealerships are trying to hit quotas often means better negotiating power. Better deals mean lower purchase prices, which means lower taxes.

4. Consider Certified Pre-Owned

A CPO vehicle is cheaper than new, which means lower sales tax. A $25,000 CPO car saves you roughly $200-$250 in taxes compared to a $30,000 new car. Over a 5-year ownership period, the tax difference is minimal, but the price difference is substantial.

5. Avoid Dealer Add-Ons

Extended warranties, paint protection, fabric protection, and other add-ons get added to your taxable purchase price. If you’re paying tax on a $500 add-on you don’t need, you’re paying an extra $40-$50 in taxes. Skip the unnecessary stuff.

For more context on how sales tax varies by location, check out our guide on Florida automobile sales tax to see how Arizona compares to other states. You might also find it helpful to understand how to find average tax rate calculations.

Out-of-State Purchase Considerations

What if you buy a car out of state and bring it to Arizona? Arizona requires you to pay sales tax on that vehicle when you register it in the state, even if you already paid sales tax elsewhere.

Here’s the important part: Arizona gives you a credit for any sales tax you paid in another state. So if you bought a car in California and paid 7.25% sales tax, you’d only owe the difference between that and Arizona’s rate when you register it locally. This prevents double taxation.

However, if you bought in a state with no sales tax (like Nevada), you’d owe the full Arizona sales tax when registering. This is why some Arizona residents near state borders occasionally make purchases in Nevada—but remember, you’re legally required to pay Arizona tax on registration, so don’t try to dodge it.

The exception: If you’re a member of the military and stationed in Arizona, you may qualify for sales tax exemptions on vehicle purchases. Check with your base’s tax advisor for specifics.

Frequently Asked Questions

Can I avoid paying sales tax on a car purchase in Arizona?

No. Arizona law requires sales tax on all vehicle purchases, whether from a dealer or private party. The only legitimate exemptions are for government agencies, non-profit organizations, and certain military personnel. If someone tells you there’s a legal way to avoid it, they’re either mistaken or suggesting tax fraud.

What’s the difference between sales tax and registration fees?

Sales tax is a percentage of the purchase price (5.6% state plus local taxes). Registration fees are flat fees set by Arizona for titling and registering the vehicle. They’re separate charges, and you owe both.

Do I pay sales tax on a leased vehicle?

Yes, but it’s calculated differently. With a lease, you pay sales tax on the monthly payment, not the full vehicle value. This typically results in lower total tax paid over the lease term compared to purchasing.

If I buy a car with a bill of sale showing a lower price, will I get caught?

Possibly. Arizona’s Department of Revenue cross-references reported prices with market values. If your reported price is significantly below what that vehicle model typically sells for, it raises red flags. Beyond the legal risk, you’re committing tax fraud, which carries penalties and interest.

Can I deduct car sales tax on my Arizona state income tax return?

You cannot deduct sales tax paid on vehicle purchases. However, if you itemize deductions on your federal return, you can deduct state and local taxes (including sales tax) up to $10,000 total under the SALT deduction limit. This is a federal deduction, not Arizona-specific.

What if the dealership makes a mistake on my sales tax calculation?

Review your paperwork carefully before signing. If you notice an error after purchase, contact the dealership immediately. If they overcharged you, they should issue a refund. If they undercharged you, Arizona may pursue you for the difference, so don’t ignore it.

Final Thoughts

Sales tax car Arizona isn’t something you can avoid, but it’s absolutely something you can minimize through smart shopping and negotiation. The difference between a well-negotiated purchase and an impulse buy can easily be $1,000-$2,000 in total costs, with a significant portion being sales tax.

Start by knowing your local tax rate—it’s the foundation of understanding your true cost. Maximize your trade-in value through research and presentation. Negotiate the purchase price aggressively. And skip the unnecessary dealer add-ons that just inflate your taxable amount.

When you’re ready to buy, you’ll walk into that dealership knowing exactly what you should pay and what the real tax impact will be. That knowledge is power, and it’s the best way to ensure you’re not overpaying for your next vehicle.

For additional context on how other states handle vehicle taxes, explore our guides on Kansas vehicle sales tax and Arizona state tax refund status to see the broader picture of tax obligations.