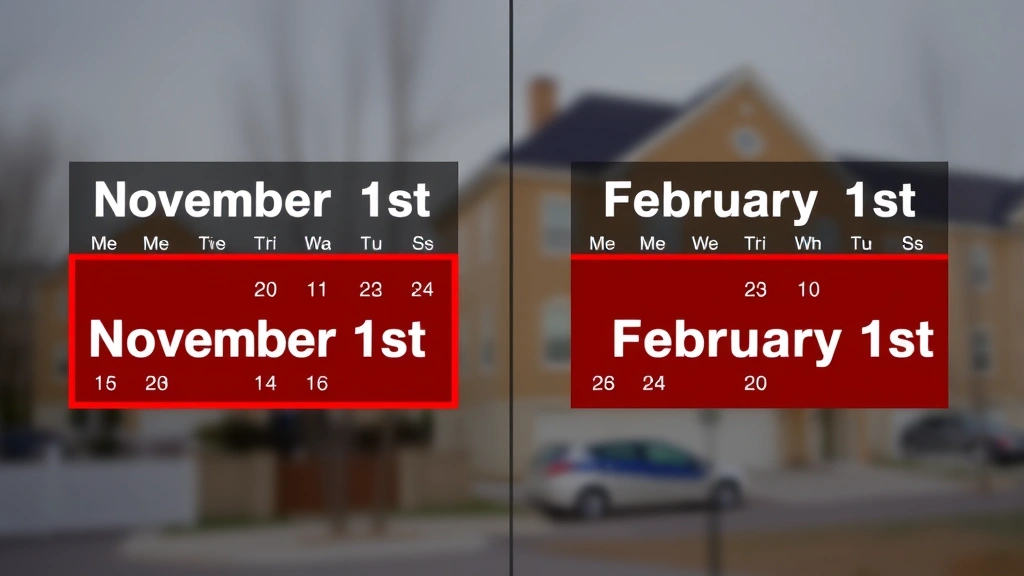

When is California property tax due? Most California property owners face two payment deadlines each fiscal year: November 1st and February 1st. Missing these dates can trigger penalties, so understanding California’s property tax calendar is essential for homeowners and investors managing their finances responsibly.

Table of Contents

- California Property Tax Payment Deadlines

- Understanding the Fiscal Year Breakdown

- Grace Periods and Late Payment Penalties

- How to Pay Your Property Taxes

- County-Specific Payment Rules

- Reading Your Property Tax Bill

- Setting Up Payment Plans

- Tax Deductions and Credits Available

- Frequently Asked Questions

California Property Tax Payment Deadlines

California operates on a fiscal year running from July 1 to June 30. Your property tax bill reflects this schedule, with two installments due during the calendar year. The first installment is due by November 1st, and the second installment is due by February 1st. If you pay after these dates but before the delinquency date (typically December 10th for the first installment and April 10th for the second), you’ll face a 10% penalty on the unpaid amount.

These deadlines are firm across California, though individual counties like Marin County and Riverside County may have slightly different enforcement procedures. The State Board of Equalization sets the statewide framework, but county tax collectors handle the actual billing and collection.

Understanding the Fiscal Year Breakdown

Property taxes in California follow a July-to-June fiscal year, which differs from the calendar year most people think in. This means your property tax bill issued in autumn covers July through June of the following year. The first installment (November 1st due date) covers July through December, while the second installment (February 1st due date) covers January through June.

If you purchase property mid-year, you may receive a supplemental tax bill reflecting the prorated amount for the remainder of that fiscal year. Similarly, if your property value changes significantly, you might see adjustments in your next bill. Understanding this fiscal timeline helps you budget appropriately and avoid surprises when bills arrive.

Grace Periods and Late Payment Penalties

California law provides a small grace period for property tax payments. While the official due date is November 1st for the first installment, you won’t incur a penalty if you pay by December 10th. For the second installment due February 1st, the delinquency date is April 10th. After these delinquency dates, a 10% penalty applies to the unpaid balance.

If you don’t pay by June 30th (the end of the fiscal year), an additional 1.5% penalty accrues monthly on the delinquent amount. After three years of non-payment, the county can initiate foreclosure proceedings on your property. This isn’t a threat to take lightly—property tax foreclosures in California are real and happen regularly. If you’re struggling financially, contact your county tax collector immediately to discuss payment arrangements rather than ignoring bills.

How to Pay Your Property Taxes

You have several convenient options for paying California property taxes. Most counties accept online payments through their official tax collector websites, which is the fastest and most secure method. You can also pay by phone, mail, or in person at your county tax collector’s office. Some counties partner with third-party payment processors, so check your specific county’s website for available methods.

If you have a mortgage, your lender may require you to pay property taxes through an escrow account included in your monthly mortgage payment. In this case, your lender handles the payment timing, though you should verify they’re paying on time. For those paying directly, set calendar reminders for October and January to ensure you don’t miss the November 1st and February 1st deadlines. Online bill pay through your bank is another reliable option.

County-Specific Payment Rules

While California’s statewide deadlines apply everywhere, individual counties may have nuanced procedures. For instance, Marin County property tax follows the standard November 1st and February 1st schedule, but their online portal has specific hours and processing times. Riverside County’s tax collector offers similar services but may have different payment processor fees.

Some counties charge convenience fees for online payments, while others waive them. Before paying, visit your county tax collector’s website to understand their specific procedures, accepted payment methods, and any associated fees. This research takes 10 minutes but could save you money and frustration. Larger counties like Los Angeles and San Francisco have robust online systems, while smaller rural counties may have more limited options.

Reading Your Property Tax Bill

Your California property tax bill arrives in autumn and contains crucial information. The bill shows your assessed property value (which county assessors determine), the tax rate applied to that value, and how much you owe for each installment. Understanding these components helps you verify accuracy and catch potential errors.

The assessed value isn’t necessarily your property’s market value. California’s Proposition 13 (1978) limits assessed value increases to 2% annually unless the property changes ownership. This means long-term homeowners often pay significantly less in property taxes than newer residents in comparable homes. If you believe your assessed value is incorrect, you can file an appeal with your county assessor’s office, typically within 30 days of receiving your bill.

Setting Up Payment Plans

If you can’t pay your full property tax bill by the deadline, don’t panic. Many California counties offer installment plans allowing you to spread payments over several months. You must request this arrangement before the delinquency date; waiting until after penalties accrue makes negotiations harder. Contact your county tax collector’s office directly to discuss options—they’re more flexible than you might expect.

Some counties also offer hardship deferrals for seniors, disabled persons, or those experiencing financial hardship. These programs may allow you to defer property taxes temporarily, though interest typically accrues. Understanding these options before you’re in crisis mode gives you breathing room and prevents the compounding penalties that make debt spiral quickly.

Tax Deductions and Credits Available

While you can’t deduct California property taxes on your state return (due to recent tax law changes), federal tax filers can deduct up to $10,000 in combined state and local taxes (SALT) on their federal return. This applies whether you pay property taxes, income taxes, or sales taxes. For high-income earners in California, this SALT cap significantly limits property tax deduction benefits.

Certain property owners qualify for special tax breaks. Seniors and disabled persons may qualify for property tax exemptions or reductions. Veterans with service-connected disabilities might receive exemptions. Additionally, understanding what tax abatement means can help you identify if your property qualifies for temporary relief if you’ve made energy-efficient improvements. Check your county assessor’s office for programs you might qualify for—leaving money on the table is a costly mistake.

Frequently Asked Questions

What happens if I miss the California property tax deadline?

If you miss the November 1st or February 1st deadline but pay by the delinquency date (December 10th or April 10th, respectively), you’ll owe a 10% penalty on the unpaid amount. After the delinquency date, additional penalties accrue at 1.5% monthly. After three years of non-payment, the county can foreclose on your property.

Can I pay California property taxes online?

Yes, most California counties accept online payments through their tax collector websites. Some charge convenience fees, so check your county’s specific procedures. Online payment is typically the fastest and most secure method.

Do I pay property taxes if I have a mortgage?

You’re legally required to pay property taxes regardless of mortgage status. If your lender requires an escrow account, they pay on your behalf through your monthly mortgage payment. If you pay directly, you’re responsible for meeting the deadlines.

Can I deduct California property taxes on my tax return?

You can deduct up to $10,000 in combined state and local taxes (including property taxes) on your federal return. California state returns don’t allow property tax deductions. The $10,000 SALT cap significantly limits deductions for high-income earners.

What’s the difference between the two California property tax installments?

The first installment (due November 1st) covers July through December of the fiscal year. The second installment (due February 1st) covers January through June. You must pay both to remain current on your property taxes.

How is my California property tax assessed?

County assessors determine your property’s assessed value based on recent sales data and property characteristics. Proposition 13 limits increases to 2% annually unless the property sells. If you disagree with your assessment, you can appeal to your county assessor’s office within 30 days of receiving your bill.

Are there payment plans available for property taxes?

Yes, many California counties offer installment plans if you request them before the delinquency date. Some counties also offer hardship deferrals for seniors, disabled persons, or those in financial distress. Contact your county tax collector’s office to discuss options.

Final Thoughts on California Property Tax Deadlines

Understanding when California property tax is due—November 1st and February 1st—is fundamental to responsible property ownership. These aren’t arbitrary dates; they’re tied to California’s fiscal year and enforced statewide. Missing these deadlines triggers penalties that compound quickly, turning manageable bills into serious financial problems.

The good news? You have options. Whether it’s setting up online payments, arranging a payment plan, or exploring available credits and deductions, proactive management prevents crisis situations. If you’re a homeowner in specific counties like Marin County or Riverside County, familiarize yourself with your county’s specific procedures and contact information.

Property taxes are one of the largest expenses homeowners face, but they’re also predictable. Mark your calendar, understand your bill, and pay on time. If you’re struggling, reach out to your county tax collector before penalties accumulate. Taking these steps now saves you thousands in penalties and stress down the road.