Understanding California property tax due dates is crucial for homeowners and property investors who want to avoid penalties and stay on top of their financial obligations. California’s property tax system operates on a fiscal year basis (July 1 to June 30), which differs from the federal tax calendar most people know. Missing these deadlines can result in late fees, increased interest charges, and even property liens. In this guide, we’ll break down exactly when your property taxes are due, how the payment system works, and what happens if you miss a deadline.

Table of Contents

California Tax Year Basics

California’s property tax system runs on a fiscal year that begins July 1 and ends June 30 of the following year. This is different from the calendar year most of us use for personal finances. The county assessor’s office determines your property’s assessed value, which forms the basis for your property tax bill. Your county tax collector then issues bills based on this assessed value, applying California’s 1% base rate (plus any local voter-approved increases).

When you purchase property in California, you’ll likely receive a supplemental property tax bill for the partial fiscal year of purchase. This is where many new homeowners get caught off guard. The supplemental bill covers the period from your purchase date until June 30 of that fiscal year. Understanding this timing helps you budget appropriately and avoid surprise bills.

Official Payment Deadlines

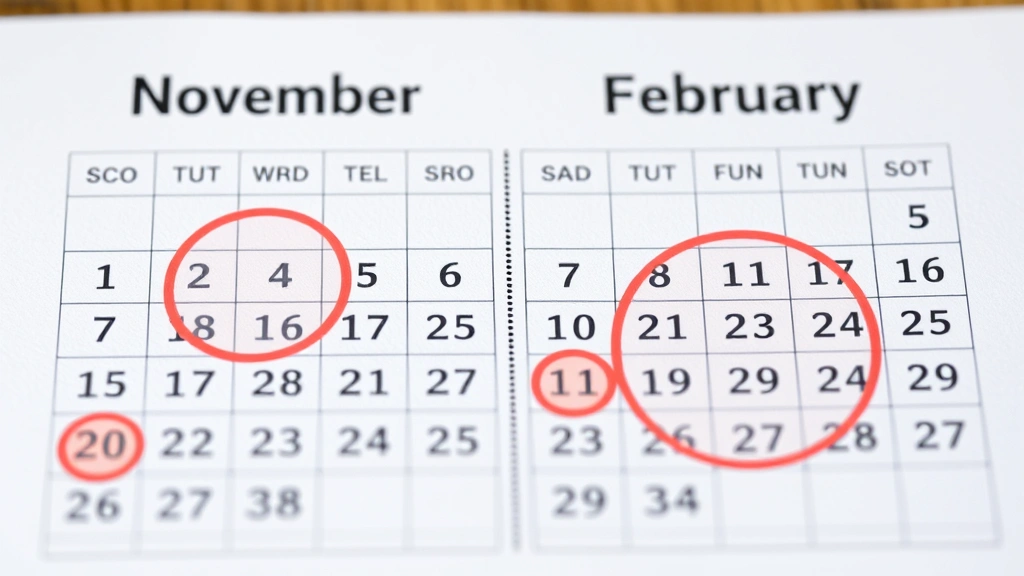

The primary California property tax due dates are split into two installments per fiscal year. The first installment is due on November 1 and becomes delinquent on December 10. The second installment is due on February 1 and becomes delinquent on April 10. These dates are firm—paying on December 11 or April 11 means you’ve missed the deadline and penalties apply.

Most property owners receive their bills in October for the first installment and in early January for the second installment. However, if you don’t receive your bill, you’re still responsible for paying on time. It’s wise to mark these dates on your calendar or set up automatic payments through your county’s tax collector website. Many counties now offer online payment portals that make this process straightforward.

If your property is in a mortgage, your lender may handle property tax payments through an escrow account. In this case, you’re still responsible for ensuring the funds are available, but the lender coordinates the actual payment to the county.

Understanding Supplemental Bills

Supplemental property tax bills are a unique aspect of California’s system that often confuses new property owners. When you purchase a home or investment property, the county assessor reassesses the property at its new market value. This triggers a supplemental bill for the remainder of that fiscal year. For example, if you buy a property in March, you’ll receive a supplemental bill covering March through June 30.

These supplemental bills typically arrive within 2-3 months of your purchase and are usually much smaller than regular annual bills since they cover only a partial year. However, they still carry the same delinquency rules. If you’re using rental property tax deductions, understanding supplemental bills is important because they affect your first-year tax obligations as a property owner.

The supplemental bill is based on the new assessed value of your property. This is why it’s critical to understand your purchase price and how it impacts your long-term property tax liability. Many investors overlook this bill entirely, which can lead to unexpected penalties.

How to Pay Your Taxes

California counties offer multiple payment methods for property taxes, making it easier than ever to pay on time. Most counties accept online payments through their tax collector’s website, which typically allows you to pay with a credit card, debit card, or electronic bank transfer. Some counties charge a convenience fee for credit card payments, so it’s worth checking your specific county’s policies.

You can also pay by mail by sending a check to your county tax collector’s office. If you choose this method, mail your payment well in advance of the deadline to account for postal delays. Payments postmarked on time are generally considered on-time, but don’t rely on this—mail early to be safe.

For those who prefer hands-on management, you can pay in person at your county tax collector’s office during business hours. Some counties also partner with third-party payment processors that accept payments at various locations. Additionally, if you have a mortgage, you can ensure timely payment by verifying that your lender’s escrow account has sufficient funds.

Understanding ad valorem tax principles helps clarify why California’s property tax system works the way it does—it’s based on the assessed value of your property, not income or other factors.

Penalties and Interest Charges

Missing California property tax deadlines comes with real financial consequences. If your first installment payment is received after December 10, you’ll face a 10% penalty on the unpaid amount. If your second installment is late (after April 10), the penalty is also 10%. These penalties are in addition to the original tax owed.

Beyond the initial penalty, interest accrues on unpaid taxes at a rate of 1.5% per month (18% annually). This compounds monthly, meaning your debt grows quickly if you don’t address it. For example, a $5,000 tax bill that’s six months late could accumulate over $450 in interest alone, plus the 10% penalty.

If taxes remain unpaid for three years, the county can initiate a tax sale process. This is where your property can be sold to recover the unpaid taxes, penalties, and costs. While the process takes time, it’s a serious consequence that every property owner should understand. The key takeaway: missing these deadlines is expensive, and the costs compound rapidly.

Know Your Rights

As a California property owner, you have rights when it comes to property tax disputes. If you believe your property has been assessed unfairly, you can file a Proposition 8 or Proposition 13 appeal with your county assessor’s office. These appeals allow you to challenge the assessed value if you believe it’s higher than the property’s actual market value.

The deadline for filing an appeal is typically 30 days after you receive your property tax bill, though this can vary by county. If your property experienced damage (fire, earthquake, etc.), you may qualify for a reduction in assessed value through a Proposition 8 claim. This process requires documentation of the damage and can result in significant property tax savings.

You also have the right to request a payment plan if you’re unable to pay your full tax bill by the deadline. Many counties will work with property owners to establish installment arrangements, though interest and penalties may still apply. It’s crucial to contact your county tax collector before the deadline to discuss options rather than simply ignoring the bill.

Setting Up Payment Plans

If you’re facing financial hardship and can’t pay your property taxes in full by the deadline, don’t panic—California counties often allow installment payment plans. You’ll need to contact your county tax collector’s office and request a payment arrangement. The specifics vary by county, but most require you to pay a portion of the debt upfront and set up a schedule for the remainder.

Payment plans typically require you to clear the debt within a specific timeframe, often 12 months. You’ll still owe interest on the unpaid balance, and any penalties that accrued before the plan was established remain in effect. However, a payment plan prevents your property from going to tax sale and stops additional penalties from accumulating.

The key is to be proactive. Contact your county before the delinquency date, not after. Demonstrating good faith by attempting to arrange payment before penalties hit shows the county you’re serious about resolving the debt. Some counties also offer hardship programs for seniors or disabled property owners, so ask about these options when you call.

Frequently Asked Questions

What are the exact California property tax due dates for 2024?

The first installment is due November 1, 2024, and becomes delinquent December 10, 2024. The second installment is due February 1, 2025, and becomes delinquent April 10, 2025. These dates are consistent year to year.

Do I have to pay property taxes if I’m selling my home?

Yes, you’re responsible for property taxes up to the close of escrow. Your title company typically prorates taxes between you and the buyer at closing, so you only pay for the portion of the year you owned the property.

Can I deduct California property taxes on my federal return?

Yes, you can deduct up to $10,000 in state and local taxes (SALT) on your federal income tax return, which may include property taxes. However, this is subject to the federal cap that took effect in 2018.

What happens if I pay my property taxes late?

You’ll incur a 10% penalty plus 1.5% monthly interest on the unpaid amount. If taxes remain unpaid for three years, your property may be subject to a tax sale.

How do I know if my property assessment is correct?

Review your property tax bill and compare the assessed value to recent comparable sales in your area. If you believe it’s too high, file a Proposition 8 appeal within 30 days of receiving your bill.

Can I pay my property taxes online?

Yes, most California counties offer online payment options through their tax collector’s website. You can typically pay with a credit card, debit card, or bank transfer.

What’s a supplemental property tax bill?

A supplemental bill covers the partial fiscal year after you purchase a property. It’s based on the new assessed value and is prorated for the number of months you own the property in that fiscal year.

Final Thoughts

Staying on top of your California property tax due dates is essential for protecting your property and avoiding expensive penalties. Mark November 1 and February 1 on your calendar, set up automatic payments if possible, and don’t ignore bills that arrive. If you purchase property, be prepared for a supplemental bill within a few months.

Remember that California’s property tax system is based on assessed value, similar to Georgia ad valorem tax structures in other states. Understanding the fundamentals helps you plan your finances more effectively. If you own rental property, factor property taxes into your investment analysis and explore available rental property tax deductions to offset these costs.

If you’re ever unsure about your obligations, contact your county tax collector’s office directly. They can clarify your specific due dates, explain supplemental bills, and discuss payment options. Most county offices are helpful and want to work with property owners to ensure timely payment. Taking action now prevents headaches—and significant expense—down the road.

For more detailed information, visit your county’s official tax collector website or the California Board of Equalization for statewide guidance on property tax matters.