If you’re an Amazon Vine member reviewing products for free or at steep discounts, you might be wondering: how are Amazon Vine items taxed? The short answer is that most Vine items are considered taxable income by the IRS, even though you didn’t pay for them. This catches many reviewers off guard come tax season, so let’s break down exactly what you owe and how to handle it properly.

Table of Contents

What is Amazon Vine?

Amazon Vine is an invitation-only program where trusted reviewers receive free or heavily discounted products to test and review. Members gain early access to new items, and Amazon gets honest feedback from real users. It sounds like a sweet deal—and it is—but the IRS views it differently than you might expect.

The program operates in multiple countries, but tax treatment varies. In the United States, the IRS classifies Vine benefits as compensation for services rendered. You’re providing a service (honest reviews), and Amazon is paying you in product form rather than cash. That distinction matters enormously when tax season arrives.

Vine Items as Taxable Income

Here’s the reality that surprises most Vine members: free products you receive through Amazon Vine are taxable income. The IRS doesn’t care that you didn’t pay cash for them. According to IRS Publication 525, if you receive goods or services as compensation for work, that’s income you must report.

Think of it this way—if your employer gave you a laptop instead of paying you $1,200 in cash, you’d still owe taxes on that $1,200 value. Vine works the same way. The moment you accept a free product, you’ve received compensation, and that compensation has a value the IRS wants to know about.

This applies whether you’re a casual reviewer or someone who takes Vine seriously. If you’re receiving multiple items monthly, those add up quickly. A reviewer getting $50-$200 worth of products monthly could face $600-$2,400+ in annual taxable income from Vine alone.

Fair Market Value Rules

The key to calculating your Vine tax liability is understanding fair market value (FMV). Fair market value is what a willing buyer would pay a willing seller for an item—essentially, the retail price on the day you received it.

Here’s how to value your Vine items correctly:

- Use the product’s Amazon price on the day you received it, not the discounted Vine price

- Check MSRP if the item isn’t currently available

- Use comparable pricing from major retailers if Amazon pricing is unclear

- Document everything with screenshots showing prices and dates

If you received a Kindle Fire tablet worth $99.99 through Vine, that’s your taxable income amount—not $0, even though you paid nothing. If you got a $45 wireless charger, that’s $45 in taxable income. The IRS expects you to report the full retail value, not what you might sell it for later.

Many reviewers make the mistake of undervaluing items or ignoring inexpensive products. That’s risky. The IRS has detailed records of what Amazon sells and at what prices. If you’re audited, they can cross-reference your reported income against actual product values.

IRS Reporting Requirements

You must report Vine income on your tax return. The question is: where and how? This depends on whether you treat Vine as a hobby or a business.

If Vine is a hobby: Report the income on Form 1040, Schedule 1, Line 8 (Other Income). You cannot deduct hobby expenses, so you’d report the full fair market value with no offsets.

If Vine is a business: Report income and expenses on Schedule C (Form 1040). This requires showing a profit motive—you’re reviewing products with the intent to make money, not just for fun. If you qualify as a business, you can deduct related expenses like equipment, software, or office supplies.

Most casual Vine reviewers should report as hobby income. However, if you’re receiving substantial products monthly ($500+), maintaining a professional review platform, or actively marketing your reviews, you might qualify for business treatment. Consult a tax professional to determine which applies to your situation.

Amazon typically does not send you a 1099 form for Vine items, even though they should technically report this as compensation. That doesn’t mean you can ignore it—you’re still legally required to report it yourself.

Deductions & Tax Strategy

If you treat Vine as a business rather than a hobby, you unlock significant tax advantages. Business reviewers can deduct legitimate expenses, which reduces taxable income.

Deductible Vine-related expenses include:

- Computer or equipment used for reviews (depreciated)

- Software subscriptions (video editing, photo editing)

- Website hosting and domain registration

- Office supplies and furniture

- Internet and phone costs (business portion)

- Travel to product demonstrations or events

- Professional development courses

The key is that expenses must be “ordinary and necessary” for your review business. You can’t deduct your entire internet bill, but you can deduct a reasonable business percentage. Similarly, you can’t deduct a $3,000 gaming PC if you only use it 10% for reviews.

For example, if you received $2,000 in Vine products annually and spent $500 on review equipment and software, your taxable Vine income would be $1,500, not $2,000. That saves you roughly $375-$450 in federal taxes (depending on your bracket), plus state taxes.

This is where working with a CPA becomes valuable. A tax professional can help you document expenses properly and maximize legitimate deductions without crossing into audit-risk territory.

Self-Employment Tax Implications

Here’s a detail many Vine reviewers overlook: if you treat Vine as self-employment income, you’ll owe self-employment tax in addition to income tax.

Self-employment tax covers Social Security and Medicare—roughly 15.3% of your net profit. If you report $2,000 in Vine income with $500 in deductions, you’d owe self-employment tax on $1,500, which is about $225 in additional taxes.

This applies only if you’re self-employed (Schedule C). If you report Vine as hobby income (Schedule 1), you don’t owe self-employment tax, but you also can’t deduct expenses. It’s a trade-off worth calculating before you file.

If you have other self-employment income (freelancing, consulting, side business), Vine income adds to that total for self-employment tax purposes. If Vine is your only income source and it’s modest ($500-$1,000 annually), the self-employment tax hit might make hobby treatment more attractive.

State & Local Tax Considerations

Beyond federal taxes, you may owe state income tax on Vine items. Most states follow federal rules and tax fair market value of goods received as compensation.

State-specific considerations:

- High-tax states (California, New York, Illinois) will tax your Vine income at 5-13%+

- No-income-tax states (Florida, Texas, Nevada, Wyoming) won’t tax Vine income federally, but may tax it locally

- Remote workers in multiple states may face complex apportionment rules

If you live in California and receive $2,000 in Vine items, you might owe 9.3% state tax ($186) on top of federal taxes. That’s real money. Some states also require you to register as a business if you’re treating Vine as self-employment income.

Check your state’s Department of Revenue website or consult a local tax professional about specific rules. State tax treatment can vary significantly from federal treatment.

Documentation & Record Keeping

The IRS loves documentation. If you’re audited, you need proof of what you received and what it was worth. Sloppy record-keeping is a red flag.

Keep these records for every Vine item:

- Date received (from your Vine dashboard)

- Product name and ASIN

- Fair market value (screenshot of Amazon price)

- Photos of the item itself

- Review you published (if applicable)

- Any related expenses (equipment, software)

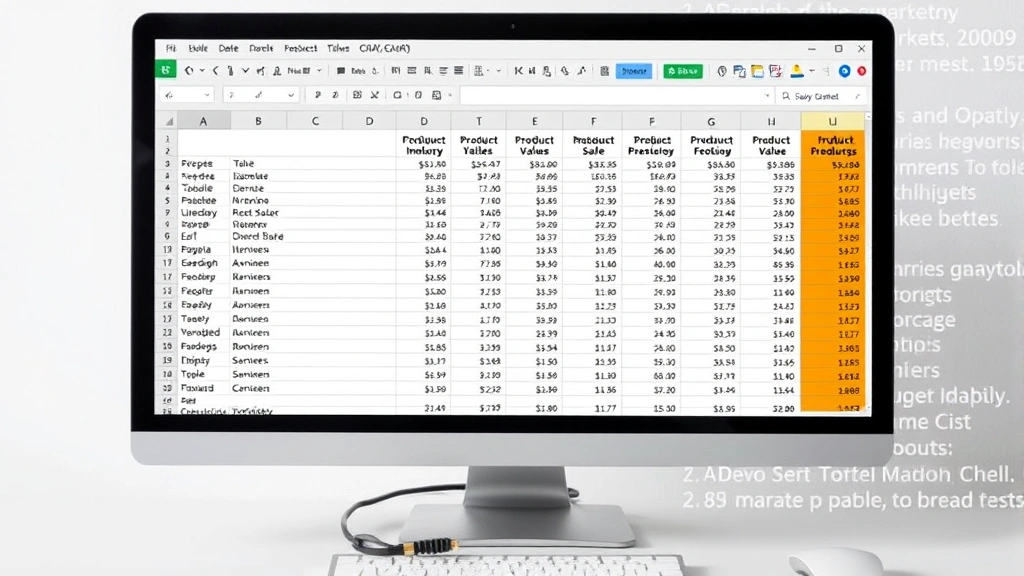

Create a simple spreadsheet tracking all Vine items by month and year. Include columns for date, product, FMV, and notes. This takes 10 minutes per month and saves you hours if the IRS comes knocking.

Keep this documentation for at least 3 years (or 7 years if you’re being extra cautious). Digital records are fine, but screenshots of Amazon prices are better than relying on memory or estimates.

Mistakes to Avoid

After years of advising clients on side income and tax on commission payments, I’ve seen Vine reviewers make predictable errors. Here’s what to avoid:

Mistake #1: Not reporting Vine income at all. The biggest risk. The IRS can cross-reference Amazon records, and unreported income is how audits start. Report it, even if it’s small.

Mistake #2: Undervaluing items. Reporting a $99 tablet as $50 because you “wouldn’t pay full price” is tax fraud. Use actual retail value, not your personal valuation.

Mistake #3: Mixing hobby and business treatment. Pick one approach and stick with it consistently. Don’t deduct expenses one year and claim hobby status the next.

Mistake #4: Forgetting about state taxes. Federal reporting is important, but state taxes add real dollars. Don’t overlook them.

Mistake #5: Deducting personal expenses. You can’t deduct your entire computer if you also use it for gaming and personal work. Be honest about business-use percentages.

Understanding your payroll vs paycheck situation helps clarify how side income affects your overall tax picture. Vine income is similar to commission income—it’s supplemental compensation that needs careful tracking.

Frequently Asked Questions

Do I owe taxes on every Amazon Vine item?

Yes, with rare exceptions. If you received a product through Vine, it’s taxable income at fair market value. The only exception would be items worth so little they’re negligible, but the IRS doesn’t provide a specific threshold, so it’s safest to report everything.

What if Amazon never sent me a 1099?

Amazon typically doesn’t issue 1099 forms for Vine items, which is technically incorrect on their part. However, you’re still legally required to report the income. Not receiving a 1099 doesn’t excuse you from reporting.

Can I deduct the items I buy myself for reviews?

If you purchase products with your own money to review them (not through Vine), those purchases are generally not deductible unless you’re operating as a registered business and can prove business purpose. Vine items are different—they’re income, not deductible purchases.

How do I value items I can’t find on Amazon anymore?

Use the MSRP from the manufacturer, check comparable pricing on other retailers (Best Buy, Walmart, Target), or use price tracking websites that show historical prices. Document your valuation method in case of audit.

Is Vine income considered earned income?

For tax purposes, Vine income is generally considered unearned income if reported as hobby income (Schedule 1), or self-employment income if reported as a business (Schedule C). It’s not W-2 wages or salary.

Should I set aside money for taxes?

Absolutely. If you’re receiving substantial Vine items ($100+ monthly), set aside 25-30% of the fair market value for taxes. This covers federal income tax, self-employment tax (if applicable), and state taxes. Many reviewers get surprised come April because they didn’t plan ahead.

What if I sell items I received through Vine?

You’ve already paid income tax on the fair market value when you received it. If you sell it later, any profit above that value is capital gains. If you sell it for less, that’s a loss (which may or may not be deductible depending on your situation). Keep records of your original FMV and sale price.