SDT: cutting datacenter tax through simultaneous data-delivery threads is a sophisticated strategy that tech-forward businesses use to optimize their operational expenses while maintaining peak infrastructure performance. If you’re running a data-intensive operation—whether you’re a cloud provider, SaaS company, or enterprise with significant server infrastructure—understanding how simultaneous data-delivery threads can reduce your tax burden is no longer optional; it’s essential to staying competitive.

Table of Contents

- What is SDT Technology?

- Understanding Datacenter Tax Burden

- How Simultaneous Data-Delivery Threads Work

- Tax Optimization Through SDT Mechanics

- Compliance and Regulatory Considerations

- Implementation Strategies for Your Business

- Cost-Benefit Analysis and ROI

- Common Mistakes to Avoid

- Future Trends in Datacenter Taxation

- Frequently Asked Questions

What is SDT Technology?

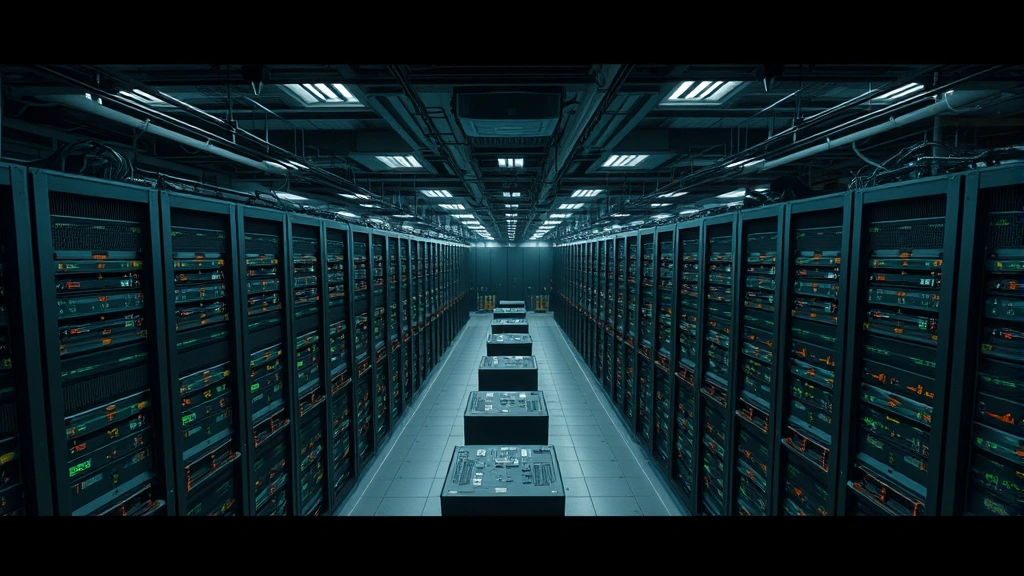

SDT stands for Simultaneous Data-Delivery Threads—a technical infrastructure approach that distributes data processing loads across multiple concurrent pathways rather than funneling everything through a single pipeline. Think of it like having multiple checkout lanes at a grocery store instead of one long line; you move more customers through faster and with less congestion.

From a tax perspective, SDT matters because it directly impacts how your datacenter operations are classified, metered, and taxed. When you optimize data delivery through simultaneous threads, you’re reducing redundancy, cutting power consumption, and potentially lowering your facility’s overall operational footprint—all factors that state and federal tax authorities consider when assessing your liability.

The technology itself isn’t new, but its application to tax strategy is increasingly recognized by forward-thinking CFOs and tax professionals who understand that infrastructure efficiency and tax efficiency are deeply connected.

Understanding Datacenter Tax Burden

Datacenter operations face a unique tax landscape. Unlike traditional retail or manufacturing, your tax exposure comes from multiple angles: property taxes on physical facilities, equipment depreciation schedules, state-level data facility taxes, and in some jurisdictions, bandwidth or throughput-based assessments.

States like Nevada have recognized the strategic importance of attracting datacenter investment and have created favorable tax environments—including modified business tax structures that can significantly reduce your exposure. Understanding your state’s specific approach is crucial. For example, some states offer Nevada Modified Business Tax incentives specifically designed for data infrastructure companies.

The typical datacenter faces annual tax bills that include:

- Property taxes on real estate and building improvements

- Equipment and machinery taxes (often the largest component)

- Franchise or privilege taxes based on gross revenue or net income

- Utility taxes on power consumption

- Local business licensing fees

For a mid-sized datacenter, these combined burdens can easily exceed 15-20% of operational costs. This is where SDT strategy enters the picture.

How Simultaneous Data-Delivery Threads Work

At its core, SDT distributes computational and data-transfer tasks across multiple parallel processes rather than sequential ones. Instead of processing requests one at a time through a single thread, SDT spins up multiple threads that work simultaneously on different data packets.

The practical benefits are substantial:

- Reduced latency: Multiple threads mean faster response times and better throughput

- Lower power consumption: Parallel processing is more efficient than sequential bottlenecking, reducing your overall energy draw

- Better resource utilization: Your hardware works smarter, not harder, extending equipment lifespan

- Scalability: You can handle traffic spikes without proportionally increasing your infrastructure footprint

From a tax angle, the real magic happens when you document how SDT reduces your facility’s operational intensity. If you can demonstrate that simultaneous data-delivery threads lowered your average power consumption per transaction by 30%, you have a compelling case for reduced equipment valuations and lower property tax assessments in jurisdictions that base taxes on facility utilization metrics.

Tax Optimization Through SDT Mechanics

Here’s where the tax strategy crystallizes: SDT enables several legitimate tax-reduction pathways.

Depreciation and Asset Classification: When you implement SDT, you’re often retiring older, less efficient equipment and replacing it with newer infrastructure. This creates opportunities for accelerated depreciation schedules under Section 179 of the tax code, potentially allowing you to deduct the full cost of new equipment in the year it’s placed in service.

Operational Expense Reduction: The efficiency gains from SDT directly reduce your operating costs. Lower utility bills mean lower utility taxes. Reduced facility footprint requirements can mean smaller real estate tax assessments. These aren’t tax deductions—they’re actual reductions in your tax base.

State Tax Credits: Many states offer investment tax credits or job creation credits for companies that upgrade their infrastructure. If your SDT implementation involves hiring new technical staff or significant capital investment, you may qualify for Franchise Tax BD CASTTAXRFD credits or similar state-level incentives.

Research and Development: If your company develops proprietary SDT implementations, you may qualify for the federal R&D tax credit, which can offset up to 15% of qualifying research expenses.

The cumulative effect is substantial. A company that strategically implements SDT while properly documenting the tax benefits could reduce their effective tax rate by 8-15% in the first year, with ongoing savings in subsequent years.

Compliance and Regulatory Considerations

Here’s where I need to put on my serious CPA hat: aggressive tax strategies without proper documentation are how companies end up in audits. The IRS and state tax authorities are increasingly sophisticated about datacenter operations, and they understand the tax-reduction potential of efficiency improvements.

To stay compliant while optimizing:

- Document everything: Keep detailed records of your SDT implementation, including technical specifications, power consumption before-and-after metrics, and the business purpose of the upgrade

- Get proper appraisals: If you’re claiming reduced property values due to operational changes, have independent appraisers document the facility’s valuation

- Consult your state tax authority: Before implementing major changes, consider a private letter ruling request in your state. It costs money upfront but can save you from audit exposure later

- Work with experienced advisors: This isn’t DIY territory. You need a tax professional who understands both datacenter operations and SDT technology

The IRS has been increasingly scrutinizing tax-exempt interest income strategies and similar aggressive positions. While SDT is fundamentally different (it’s about operational efficiency, not creative structuring), the lesson is clear: transparency and documentation are your best defense.

Implementation Strategies for Your Business

If you’re considering SDT for tax optimization, here’s a practical roadmap:

Phase 1: Assessment (Months 1-2)

Conduct a detailed audit of your current datacenter operations. Measure your baseline: power consumption, equipment utilization rates, thermal efficiency, and current tax burden by category. This baseline is essential—you can’t measure improvement without knowing where you started.

Phase 2: Planning (Months 2-4)

Work with your IT team and tax advisors to design an SDT implementation plan. This should include:

- Technical specifications for the new system

- Capital investment required

- Projected operational savings (power, cooling, space)

- Timeline for implementation

- Tax implications and opportunities

Phase 3: Implementation (Months 4-8)

Roll out your SDT infrastructure in phases if possible. This allows you to measure results incrementally and adjust your approach. Document everything meticulously.

Phase 4: Tax Optimization (Months 8-12)

Work with your tax team to properly claim all available deductions and credits. This might include estimated taxes adjustments if your savings are significant enough to warrant updated quarterly payments.

Cost-Benefit Analysis and ROI

Let’s talk numbers. A typical mid-market datacenter might invest $500,000-$2 million in SDT infrastructure. What’s the return?

Direct operational savings: A well-implemented SDT system typically reduces power consumption by 25-35%, cooling costs by 20-30%, and can defer or eliminate facility expansion needs. For a facility spending $1 million annually on utilities, this translates to $250,000-$350,000 in annual savings.

Tax savings: These operational savings generate tax benefits:

- Lower utility taxes: ~$25,000-$35,000 annually

- Reduced property tax assessments: ~$50,000-$100,000 in year one, ongoing

- Depreciation benefits: $150,000-$300,000 in year one (depending on asset classification)

- Potential R&D credits: $75,000-$150,000 if development was involved

Total first-year tax benefits could reach $300,000-$585,000. If your investment was $1 million, you’re looking at a 30-58% return in tax savings alone, before accounting for operational cost reductions.

Payback period: typically 2-4 years, with ongoing benefits extending 10+ years as the infrastructure ages.

Common Mistakes to Avoid

I’ve seen companies leave money on the table—or worse, face audit issues—by making these mistakes:

Mistake #1: Claiming tax benefits without operational improvements

Don’t try to claim depreciation or tax credits for SDT implementation if you haven’t actually reduced your operational footprint. The IRS will compare your power bills, facility size, and equipment valuations. Inconsistencies trigger audits.

Mistake #2: Ignoring state tax implications

Federal tax benefits are only part of the story. Your state may have specific rules about equipment depreciation or facility valuation. A strategy that’s perfectly legal federally might create state tax issues. This is why state-specific guidance matters—like understanding your state’s approach to tax canopy regulations.

Mistake #3: Inadequate documentation

If you can’t prove the technical improvements and resulting operational changes, you can’t claim the tax benefits. Keep detailed records of equipment specifications, power consumption data, before-and-after facility assessments, and the business purpose of the investment.

Mistake #4: Timing the implementation poorly

If you’re planning a major SDT implementation, timing matters for tax purposes. Implementing in Q4 gives you only partial-year depreciation benefits. Implementing in Q1 maximizes your year-one tax benefits. Work with your tax team to optimize timing.

Mistake #5: Underestimating complexity

SDT implementation is technically complex and tax-strategically nuanced. Trying to do this without experienced advisors is false economy. The cost of proper planning and execution is typically 2-3% of your total investment—a small price for avoiding costly mistakes.

Future Trends in Datacenter Taxation

The tax landscape for datacenters is evolving. Here’s what I’m watching:

Carbon Tax Implications: Several states and the EU are moving toward carbon taxes or credits. Efficient SDT implementations that reduce power consumption will increasingly generate tax credits, not just cost savings. This trend favors companies that optimize early.

Increased IRS Scrutiny: As the IRS becomes more sophisticated about technology operations, expect increased examination of datacenter tax positions. Aggressive strategies will face more challenges. Conservative, well-documented approaches will hold up better.

State Tax Competition: States are competing for datacenter investment by offering tax incentives. If you’re considering relocation or expansion, the tax differential between states could be substantial—potentially 20-30% of your total tax burden.

ESG Tax Integration: Environmental, Social, and Governance considerations are increasingly affecting tax policy. Companies with efficient, sustainable datacenters will have better access to favorable tax treatment.

Frequently Asked Questions

Is SDT implementation guaranteed to reduce my datacenter taxes?

Not guaranteed, but highly likely if properly executed. The tax benefits depend on actual operational improvements that you can document. If your SDT implementation genuinely reduces power consumption and facility footprint, the tax benefits follow naturally. The key is documenting the improvements thoroughly.

How much can I realistically save in taxes through SDT?

For a typical mid-market datacenter, first-year tax savings range from 8-15% of total tax burden, with ongoing savings of 5-10% in subsequent years. The exact amount depends on your current tax burden, the scope of your SDT implementation, and your state’s tax environment. A detailed analysis with your tax advisor will give you specific numbers for your situation.

Do I need special permits or approvals to implement SDT?

Technically, no—SDT is a standard infrastructure approach. However, if your implementation involves significant facility modifications, you may need building permits. More importantly, if you’re claiming substantial tax benefits, consider requesting a private letter ruling from your state tax authority before implementation. It adds cost upfront but provides certainty.

Can I claim R&D tax credits for SDT development?

Possibly, but only if your company is developing proprietary SDT technology, not just implementing existing solutions. If you’re customizing off-the-shelf SDT systems for your specific facility, you likely don’t qualify. This is a nuanced area where professional guidance is essential.

How does SDT implementation affect my equipment depreciation schedules?

When you implement SDT, you’re typically retiring older equipment and acquiring new infrastructure. The new equipment gets its own depreciation schedule—typically 5-7 years for computer equipment under MACRS. You may also qualify for Section 179 expensing, which allows you to deduct the full cost in the year acquired (subject to annual limits).

What’s the relationship between SDT and my state’s franchise tax?

This depends entirely on your state’s franchise tax structure. Some states base franchise taxes on gross revenue, others on net income, and some on specific metrics like equipment value. SDT’s impact on your franchise tax depends on how your state calculates it. This is why understanding your state’s specific rules—like those governing franchise tax calculations—is critical.

Final Thoughts: Making SDT Work for Your Bottom Line

SDT: cutting datacenter tax through simultaneous data-delivery threads isn’t a gimmick or aggressive tax shelter. It’s a legitimate, increasingly mainstream approach to optimizing both your operational efficiency and your tax position. The companies that implement SDT effectively are the ones that:

- Focus first on genuine operational improvements, not tax benefits

- Document everything meticulously

- Work with experienced advisors who understand both technology and tax

- Take a state-specific approach to tax planning

- Plan implementation timing strategically

The tax benefits follow naturally from real operational improvements. That’s the key insight that separates legitimate strategy from aggressive positioning: when you actually reduce your power consumption, equipment footprint, and facility costs, the tax system is designed to recognize those improvements through lower depreciation bases, reduced property taxes, and available credits.

If you’re running a datacenter and haven’t evaluated SDT, you’re likely leaving significant money on the table. The investment in proper planning and implementation typically pays for itself within 2-4 years, with ongoing benefits extending a decade or more. That’s the kind of financial decision that deserves serious consideration.