Understanding florida property tax elimination strategies can save Florida homeowners thousands of dollars annually. While complete property tax elimination isn’t realistic for most residents, several legitimate exemptions and programs can significantly reduce your tax burden. Let’s break down what actually works and what’s hype.

Table of Contents

Homestead Exemption Basics

The homestead exemption is Florida’s primary tool for property tax relief. If you own your primary residence in Florida, you’re likely eligible for this exemption, which reduces your home’s assessed value for tax purposes.

Here’s how it works: The exemption removes up to $50,000 from your home’s assessed value. So if your home is worth $300,000, the taxable value becomes $250,000. That $50,000 difference translates directly into lower property taxes. For many homeowners, this single exemption cuts their annual bill by 15-25%.

To qualify, you must own the property and maintain it as your primary residence on January 1st of the tax year. You can’t claim homestead exemption on investment properties or vacation homes, which is where many people get confused.

The exemption applies to your county taxes, school district taxes, and municipal taxes. It’s one of the most straightforward ways to reduce your burden, yet roughly 20% of eligible Florida homeowners never file for it.

Save Our Homes Amendment Protection

Once you have your homestead exemption, the Save Our Homes (SOH) Amendment kicks in. This is where Florida’s property tax system gets genuinely interesting—and powerful for long-term homeowners.

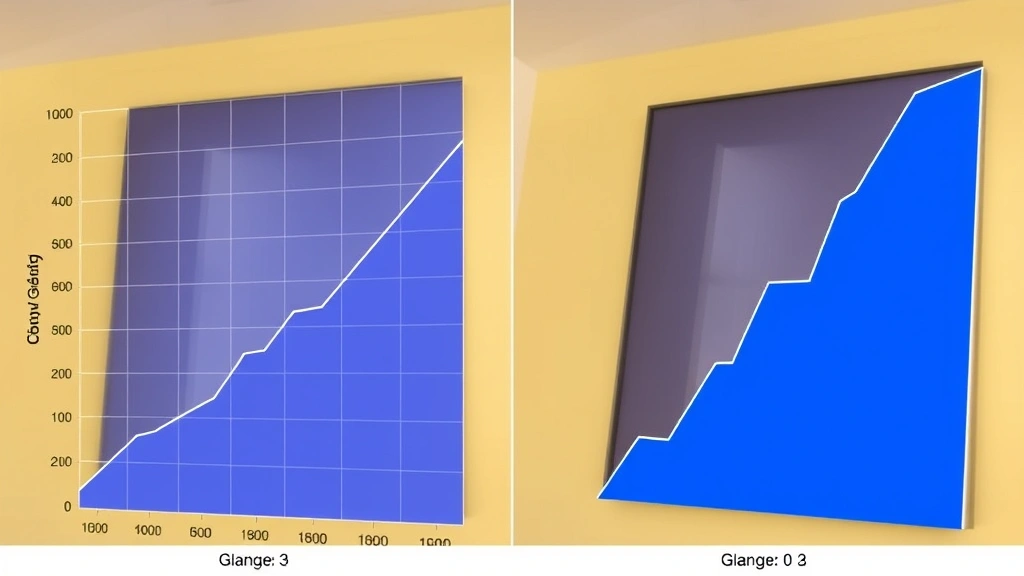

The SOH Amendment caps annual assessment increases at 3% per year, regardless of how much your home’s market value actually increases. This creates a huge gap between your assessed value and your actual market value over time.

Here’s a real example: You buy a home for $200,000 in 2010. Fast forward to 2024, and similar homes in your neighborhood sell for $450,000. Without SOH protection, your assessed value would climb toward that $450,000. With SOH, your assessed value can only increase 3% annually, keeping it around $270,000.

That protection is worth tens of thousands of dollars over your ownership period. When you sell the home, the assessment resets to market value for the new owner, but you’ve enjoyed years of tax savings.

This is why Florida attracts retirees and long-term residents—the combination of homestead exemption plus SOH Amendment creates genuine property tax stability. However, it also means your taxes won’t increase as dramatically if you stay put, which is the trade-off.

Additional Exemptions Available

Beyond the standard homestead exemption, Florida offers several other property tax exemptions that many homeowners don’t know about:

Widow/Widower Exemption: If you’re a surviving spouse of a homestead exemption recipient, you can continue receiving the exemption for up to six months after your spouse’s death, and potentially longer under certain circumstances.

Disability Exemption: If you or your spouse is permanently and totally disabled, you may qualify for an additional $500,000 exemption on your home’s assessed value. This is substantial for eligible homeowners.

Veteran’s Exemption: Disabled veterans can receive exemptions ranging from $500 to $5,000 depending on disability rating. The U.S. Department of Veterans Affairs determines eligibility.

Age 65+ Exemption: Homeowners age 65 and older can claim an additional exemption if their household income is below a certain threshold (currently around $20,000 for single filers).

These exemptions can stack with your homestead exemption, creating layered tax relief. A disabled veteran over 65 might qualify for multiple exemptions simultaneously, dramatically reducing their tax burden.

Property Tax Caps Explained

Florida’s property tax system includes several caps that work together to limit your overall burden. Understanding these caps helps explain why your property taxes might not increase as much as you’d expect.

The 3% annual cap (from SOH Amendment) applies to your assessed value. But there’s another layer: the millage rate cap. Counties can’t increase their millage rates beyond a certain threshold without voter approval.

Additionally, if your property value drops, your assessed value can decrease immediately—you don’t have to wait for the 3% cap to work in your favor. This became relevant during the 2008 housing crisis when many homeowners saw tax relief.

The caps system creates predictability. Unlike states where property taxes spike dramatically after reassessment, Florida homeowners with homestead exemption can reasonably forecast their tax increases. This stability is a major selling point for the state.

However, these caps also mean school funding can become unpredictable, which is why Florida occasionally faces educational funding challenges. The tax relief for homeowners comes at a cost to public services, a trade-off worth understanding.

Myths About Total Elimination

Let’s address the elephant in the room: You cannot completely eliminate your Florida property taxes through legal means. Anyone claiming otherwise is selling you snake oil.

The homestead exemption, SOH Amendment, and additional exemptions can reduce your taxes significantly—sometimes by 50% or more for eligible homeowners. But they don’t eliminate them entirely. You’ll still owe property taxes; they’ll just be lower than the full assessed value.

Some people claim you can eliminate taxes by creating trusts, transferring property to LLCs, or using other creative structures. These strategies don’t work for property tax purposes. Florida law specifically prevents these workarounds. The state has seen every trick, and the tax code accounts for them.

Others suggest that paying taxes is voluntary or that property taxes are unconstitutional. These arguments have been thoroughly rejected by courts and won’t protect you from liens or foreclosure.

The realistic goal isn’t elimination—it’s optimization. By stacking all available exemptions and understanding how the assessment and cap system works, you can legitimately reduce your property tax burden by 30-60%. That’s substantial without being fantasy.

How to File for Exemptions

Filing for your homestead exemption is straightforward, though deadlines matter. You must apply by March 1st of the year you want the exemption to take effect.

Visit your county property appraiser’s office (find yours at your county’s website) and request a homestead exemption application. You’ll need:

- Proof of ownership (deed or mortgage statement)

- Proof of residency (utility bill, lease, or voter registration)

- Your Social Security number

- A signed application

Many counties now allow online filing through their property appraiser website. This is faster and eliminates the need to visit in person. You’ll upload documents and receive confirmation immediately.

For other exemptions (disability, veteran, age 65+), you’ll need additional documentation. The property appraiser’s office can tell you exactly what’s required for your specific situation.

Once approved, the exemption remains in effect as long as you own the property as your primary residence. You don’t need to reapply annually. However, if you move or rent out your home, you must notify the appraiser to remove the exemption.

If you’ve owned your home for years and never filed, you can still apply. In most cases, you’ll receive a refund for back taxes dating to when you first became eligible. That refund can be substantial, sometimes thousands of dollars.

Maximize Your Tax Savings

Beyond filing for exemptions, several strategies can further optimize your property tax situation:

Challenge Your Assessment: If you believe your home’s assessed value is too high, you can appeal. The property appraiser must justify their valuation. If you can show comparable sales at lower prices, you might get your assessment reduced. This is especially valuable in declining markets.

Understand Your Tax Bill: Your property tax bill includes taxes for multiple entities: county, school district, city, and special districts. Each has its own millage rate. Understanding which portions fund what helps you see where your money goes and can inform voting decisions on millage increases.

Review Portability: If you’re considering moving within Florida, remember that your SOH assessment protection can be “portable” to a new home if you meet certain requirements. This means your capped assessment value can transfer to your new property, preserving your tax savings. Consult your property appraiser about portability before selling.

Document Everything: Keep records of your homestead exemption filing and all property tax bills. If there’s ever a dispute, documentation protects you. Also, maintain your primary residence status—don’t rent it out or you’ll lose exemptions.

For more on optimizing your overall tax strategy, review our guide on Florida Property Tax Reform to understand legislative efforts that might affect future tax obligations.

Recent Legislative Changes

Florida’s property tax landscape has shifted in recent years. In 2023, the state increased the homestead exemption from $50,000 to $75,000 for homes valued over $150,000. This change provides additional relief for homeowners with higher-value properties.

Additionally, the disability exemption was expanded, increasing the maximum exemption value and broadening eligibility criteria. These changes reflect legislative efforts to provide more property tax relief to Florida residents.

School funding changes have also affected how property taxes are allocated. Understanding these changes helps you see where your tax dollars go and anticipate future adjustments. The state continues to debate property tax reform, with proposals ranging from expanding exemptions to restructuring how taxes are assessed.

Staying informed about legislative changes is crucial. What works today might change next year. Subscribe to your county property appraiser’s updates or check their website annually for changes affecting your exemptions.

For context on how Florida’s approach compares to other states, our article on California State Estimated Tax Payments shows how different states handle property tax differently.

Frequently Asked Questions

Can I eliminate my Florida property taxes completely?

No. While exemptions and caps can reduce your taxes by 30-60%, complete elimination isn’t possible through legal means. Anyone promising total elimination is misrepresenting the law. The goal should be optimization, not elimination.

What if I own property in multiple Florida counties?

You can only claim homestead exemption on one property—your primary residence. If you own investment properties or vacation homes in other counties, those won’t qualify for homestead exemption and will be taxed at full assessed value.

Do I lose my SOH protection if I make improvements to my home?

No. The Save Our Homes Amendment continues to apply even after renovations. However, the assessed value will increase to reflect the improvement’s value, but the 3% annual cap still applies going forward.

What happens to my exemptions when I sell my home?

Your exemptions end when you sell. The new owner must apply for their own homestead exemption. The assessment resets to market value, which means the new owner starts fresh without SOH protection (unless they qualify for portability).

Can I claim homestead exemption on a rental property I live in?

Only if you’re the owner and it’s your primary residence. If you rent out part of it while living there (like a duplex where you occupy one unit), you can still claim homestead exemption on your portion. Consult your property appraiser for your specific situation.

What’s the difference between homestead exemption and SOH Amendment?

Homestead exemption removes $50,000-$75,000 from your assessed value immediately. SOH Amendment caps annual increases at 3% regardless of market appreciation. Both work together: exemption reduces current taxes, SOH keeps them from growing too fast.

How do I know if I’m eligible for disability exemption?

You need documentation from the U.S. Department of Veterans Affairs (if military-related) or your physician (if non-military disability). Contact your county property appraiser’s office with your documentation to determine eligibility and exemption amount.

Can I apply for homestead exemption retroactively?

Yes, in most cases. If you’ve owned your home for years without filing, you can apply now and receive a refund for back taxes. The refund period varies by county but typically covers several years. Contact your property appraiser immediately if this applies to you.