A Broward County business tax receipt is a mandatory license that authorizes you to legally operate a business within Broward County, Florida. Whether you’re launching a startup or expanding an existing operation, understanding this requirement is essential to staying compliant and avoiding penalties.

Table of Contents

What Is a Business Tax Receipt?

Think of your business tax receipt as your official permission slip from Broward County. It’s not a state-level business license—it’s a local requirement that proves you’ve registered with the county and paid the associated fees. This receipt is proof that you’re operating legally within Broward County’s jurisdiction.

The receipt itself is a physical document (or digital record) issued by the Broward County Tax Collector’s office. It includes your business name, address, type of business, and the dates your license is valid. You’ll need to display this prominently at your business location, and you should keep a copy for your records.

Unlike some other business licenses that focus on specific industries (like contractor licenses or food service permits), the business tax receipt is a general requirement for most businesses operating in the county. It’s essentially your baseline compliance document.

Who Needs One in Broward?

The short answer: almost every business operating in Broward County needs a business tax receipt. This includes sole proprietorships, partnerships, corporations, LLCs, and nonprofits (though nonprofits may have different fee structures).

Specific examples include:

- Retail stores and e-commerce businesses with a physical presence

- Service providers (plumbing, electrical, consulting, etc.)

- Professional offices (medical, dental, legal)

- Restaurants and food service operations

- Real estate agents and brokers

- Contractors and construction companies

- Home-based businesses (yes, even if you work from your garage)

There are limited exemptions—primarily for certain government agencies and some agricultural operations—but if you’re reading this, you almost certainly need one. The Commercial Tax Officer can clarify your specific situation if you’re unsure.

How to Obtain Your Receipt

Getting your business tax receipt is straightforward, though it requires some paperwork. Here’s the step-by-step process:

Step 1: Gather Required Documents

You’ll need to provide proof of your business structure. This typically includes:

- Articles of Incorporation (for corporations)

- Articles of Organization (for LLCs)

- Partnership agreement (for partnerships)

- Sole proprietorship documentation or DBA certificate

- Federal Employer Identification Number (EIN) or Social Security Number

- Proof of business address (lease, deed, or utility bill)

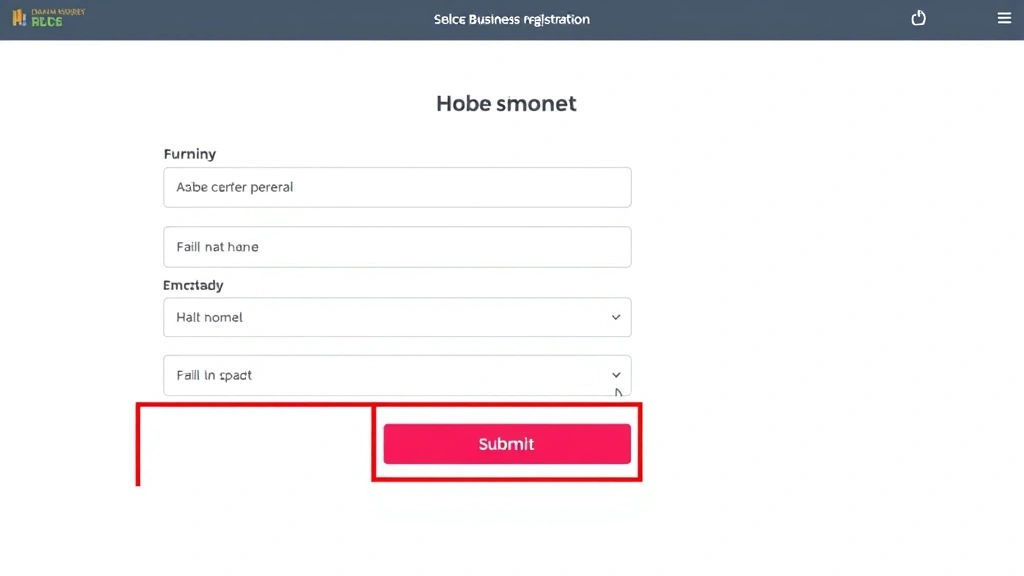

Step 2: Complete the Application

Visit the Broward County Tax Collector’s website or office to access the application form. You can apply online, by mail, or in person. Online is typically fastest and most convenient.

Step 3: Submit and Pay Fees

Submit your completed application along with the required fee. Payment can usually be made online, by check, or in person.

Step 4: Receive Your Receipt

Once approved, you’ll receive your business tax receipt, usually within a few business days if you applied online. Display it prominently at your business location.

The entire process typically takes 1-2 weeks. If you need it faster, the Tax Collector’s office may offer expedited processing for an additional fee.

Costs and Annual Fees

Let’s talk money. The cost of a Broward County business tax receipt varies based on your business type and gross revenue.

Fee Structure (2024)

Broward County uses a tiered system. Most businesses pay an annual fee ranging from $50 to $500, depending on their gross receipts (revenue). The county publishes a fee schedule that categorizes businesses by type and size.

For example:

- Very small businesses (under $5,000 annual revenue): Often minimal fees, sometimes $50-100

- Small to mid-size businesses ($5,000-$500,000): Typically $100-300

- Larger businesses ($500,000+): $300-500+

These are approximate ranges—your actual fee depends on your specific classification. Some business types (like certain professional services) may have fixed fees regardless of revenue.

Additional Costs to Consider

Beyond the basic receipt fee, budget for:

- Professional assistance (CPA or business attorney): $200-500 if you need help with the application

- Expedited processing: Usually $25-50 extra

- Replacement receipt if lost: Typically $10-25

It’s a relatively modest investment compared to other business startup costs, but it’s non-negotiable.

Renewal and Compliance

Your business tax receipt isn’t a one-time thing—it expires annually, typically on December 31st. Missing the renewal deadline is a common mistake that can result in penalties.

Renewal Timeline

The Tax Collector typically sends renewal notices in October or November. You have until December 31st to renew. Here’s the thing: don’t wait until December 30th. The system gets overloaded, and you might face processing delays or late fees.

How to Renew

Renewal is even easier than the initial application:

- Visit the Broward County Tax Collector’s website

- Log into your account or provide your receipt number

- Verify your business information (update anything that’s changed)

- Pay the renewal fee

- Receive your renewed receipt

Most renewals can be completed online in under 10 minutes. You can renew as early as October and should do so by mid-December to avoid any issues.

What If Your Business Changes?

If you move locations, change your business structure, or significantly alter your business type, you’ll need to update your receipt. Contact the Tax Collector’s office to amend your registration. These changes are usually processed quickly and may not require an additional fee, though relocation might trigger a new registration requirement depending on which city within Broward County you’re moving to.

Common Mistakes to Avoid

After years of working with business owners, I’ve seen the same preventable errors repeatedly. Here’s what to watch out for:

Mistake #1: Forgetting to Renew

This is the #1 violation I see. Business owners get busy, the renewal notice goes to spam, and suddenly they’re operating without a valid receipt. Operating without a current receipt can result in fines and potential business closure orders.

Mistake #2: Not Updating Information

You moved your office, changed your business name, or restructured your company—but didn’t update your receipt. This creates a mismatch between your official registration and your actual business, which can cause problems with permits, loans, or IRS audits.

Mistake #3: Misunderstanding the Scope

Some business owners think the business tax receipt covers everything—it doesn’t. You may still need industry-specific licenses (contractor licenses, food service permits, professional licenses, etc.). The receipt is just the baseline.

Mistake #4: Not Keeping Records

Keep a copy of your receipt and renewal confirmations. You’ll need these for tax purposes, loan applications, and potential audits. Digital copies are fine, but have them accessible.

Mistake #5: Delaying Application

Operating without a receipt while “waiting to see if the business takes off” is risky. Apply immediately—the fee is modest, and the legal protection is worth it. Plus, many landlords and service providers require proof of a valid receipt before doing business with you.

Tax Implications and Deductions

Here’s where business tax receipts intersect with your actual tax situation. While the receipt itself is a compliance requirement, it has real tax implications.

Deductibility of Fees

The good news: your annual business tax receipt fee is tax-deductible as a business expense. You can claim it on your federal tax return (Schedule C for sole proprietors, or on your business tax return for other structures). This reduces your taxable income, so the net cost is actually lower than the fee itself.

For example, if you pay $200 for your receipt and you’re in the 22% federal tax bracket, the fee effectively costs you $156 after the tax deduction.

Relationship to Sales Tax

The business tax receipt is separate from sales tax registration. However, many businesses need both. If you collect sales tax, that’s a different registration and reporting requirement. Don’t confuse the two—both are required if applicable to your business.

Record-Keeping for Audits

Keep your receipt and renewal records as part of your permanent business files. If you’re ever audited by the IRS or Florida Department of Revenue, having proof of your Broward County registration strengthens your position. It shows you’re serious about compliance.

For more context on business tax obligations, check out What is a Tax Abatement and Tax Abatement Meaning to understand broader tax relief options that might apply to your situation.

Penalties for Non-Compliance

Let’s be direct: operating without a valid business tax receipt in Broward County isn’t just a minor oversight—it’s a violation with real consequences.

Financial Penalties

Late renewal fees typically start at $50-100 and can escalate. If you’re significantly overdue (more than 60-90 days), penalties can reach $500 or more. The longer you wait, the worse it gets.

Business Closure Orders

In serious cases, Broward County can issue a cease-and-desist order, effectively shutting down your business operations until you’re in compliance. This isn’t theoretical—I’ve seen it happen to businesses that ignored multiple notices.

Difficulty Obtaining Other Permits

Want to get a building permit? Apply for a business loan? Hire employees? Many of these processes require proof of a valid business tax receipt. Operating without one creates cascading problems.

Liability Issues

If you’re operating illegally (without a receipt), your business liability insurance might not cover you in case of a lawsuit. This is a serious gap in your protection.

IRS and State Revenue Scrutiny

Operating without proper local registration can trigger audits from the IRS or Florida Department of Revenue. They see you reporting business income without proper local authorization and start asking questions. It’s easier to just stay compliant from the start.

Frequently Asked Questions

Do I need a business tax receipt if I work from home?

Yes. Home-based businesses in Broward County still need a business tax receipt. Your home address is your business address for registration purposes. The only exception might be if you’re a freelancer with no separate business location, but even then, you should verify with the Tax Collector’s office.

How long does it take to get approved?

Online applications typically receive approval within 1-3 business days. Paper applications may take 5-10 business days. If you need it urgently, ask about expedited processing when you apply.

What if I’m moving my business to a different city in Broward County?

You’ll need to update your registration with your new address. Depending on your new location and business type, you may need to apply for a new receipt or simply amend your existing one. Contact the Tax Collector’s office—they’ll guide you through the process.

Can I apply for a business tax receipt before my business officially opens?

Yes. In fact, it’s recommended. You can apply as soon as you have your business structure in place (LLC formed, DBA registered, etc.), even if you haven’t started operations yet. This ensures you’re compliant from day one.

What happens if I don’t renew by December 31st?

Your receipt becomes invalid on January 1st. Operating after that date without a valid receipt is a violation. Renew immediately if you miss the deadline—late fees apply, but it’s still better than continuing to operate illegally.

Is the business tax receipt the same as a business license?

Not exactly. The receipt is Broward County’s local business registration. A business license is often a separate, industry-specific credential (like a contractor license or real estate license). You may need both, depending on your business type.

Can I deduct the receipt fee on my taxes?

Yes. The annual business tax receipt fee is deductible as a business expense on your federal tax return, reducing your taxable income.

What if I close my business mid-year?

Contact the Tax Collector’s office to close your registration. You may be entitled to a prorated refund, depending on when you close. Don’t just stop renewing—formally close your account to avoid confusion and potential future issues.

Final Thoughts

Your Broward County business tax receipt is a straightforward requirement that protects both you and the county. It’s affordable, easy to obtain, and essential for legal operation. The biggest mistake business owners make is procrastinating—apply early, renew on time, and keep your records organized.

Think of it as the foundation of your business compliance. It’s not glamorous, but it’s non-negotiable. Stay on top of your renewal dates, update your information when things change, and you’ll never have to worry about this requirement again. Your future self (and your accountant) will thank you.

For related information on local tax requirements, explore resources like Fairfax County Government Taxes and Lee County Tax Collector Lehigh Acres to understand how other Florida counties handle similar requirements.