What Is North Carolina Sales Tax? Essential 2024 Guide

what is north carolina sales tax: North Carolina's state sales tax is 4.75%, plus local taxes of 2-2.75%. Learn what's taxed, exemptions, and how it compares na

what is north carolina sales tax: North Carolina's state sales tax is 4.75%, plus local taxes of 2-2.75%. Learn what's taxed, exemptions, and how it compares na

what is ca sdi tax: California's SDI tax is a mandatory 1.0% payroll deduction funding temporary disability insurance. It replaces 55-66% of your wages when you

what is a tax warrant: A tax warrant is a legal document giving the IRS power to seize your property, bank accounts, and wages to collect unpaid taxes. Learn ho

what is a 5498 tax form: Form 5498 reports IRA contributions to the IRS. Your financial institution sends it by May 31st. Learn what it means, who needs it, and

what are ad valorem taxes: Ad valorem taxes are property taxes based on assessed value. Learn how they're calculated, state variations, and legitimate strategie

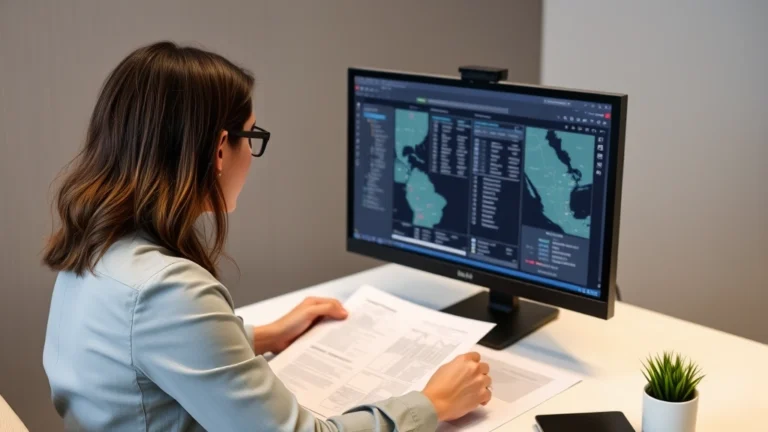

Wayne County tax map shows property assessments, values, and tax information. Learn to access it, understand assessments, and challenge valuations to save money

The Wayne County PA tax map reveals property assessments and helps you challenge overvaluation. Learn to access maps, spot errors, and legally reduce your prope

Washington state death tax affects estates over $2.193M. Learn proven strategies to minimize it: lifetime gifting, irrevocable trusts, charitable giving, and po

walmart cashier monthly salary after taxes: A Walmart cashier earning $15/hour takes home approximately $2,000-$2,200 monthly after federal, state, and FICA tax

virginia state sales tax rate: Virginia's state sales tax rate is 5.3%, but combined with local taxes, your total rate ranges from 5.3% to 7.6% depending on loc