If you’re wondering how much is sales tax in Ohio, you’re not alone—understanding your state’s tax rates is crucial for budgeting, business planning, and making informed purchasing decisions. Ohio’s sales tax structure is more nuanced than you might think, with state and local rates that vary depending on where you shop and what you’re buying.

Table of Contents

Ohio’s State Sales Tax Rate

Ohio charges a 5.75% state sales tax, which is relatively modest compared to other states. This base rate applies to most retail purchases across the state, but here’s where it gets interesting: Ohio allows counties and municipalities to add their own local sales taxes on top of the state rate. That means your actual tax burden depends heavily on where you’re shopping.

Think of it like layers of a cake—the 5.75% is your foundation, but your county or city might add another 0.5% to 2.25% depending on local needs and budget priorities. This is why two purchases of identical items in different Ohio cities can result in different total costs.

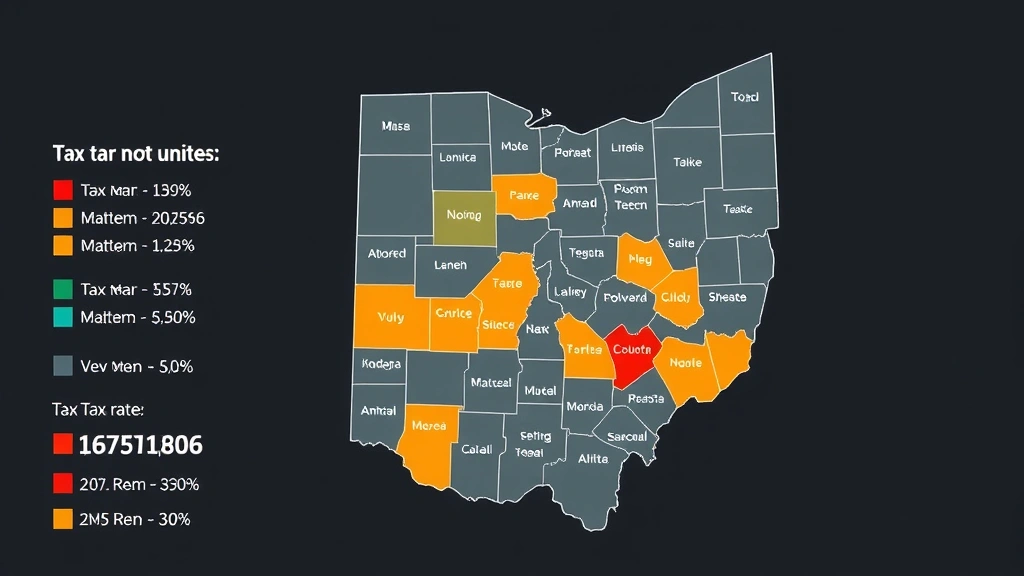

Local Sales Tax Rates by County

Ohio’s 88 counties have varying local sales tax rates, ranging from 0% to 2.25% additional tax. Here’s what you need to know:

- Franklin County (Columbus): 7.5% combined rate (5.75% state + 1.75% local)

- Cuyahoga County (Cleveland): 8% combined rate (5.75% state + 2.25% local)

- Hamilton County (Cincinnati): 7.5% combined rate (5.75% state + 1.75% local)

- Summit County (Akron): 7.5% combined rate (5.75% state + 1.75% local)

- Lucas County (Toledo): 7% combined rate (5.75% state + 1.25% local)

- Montgomery County (Dayton): 7.25% combined rate (5.75% state + 1.5% local)

If you’re in a county with no local sales tax addition, you’ll pay exactly 5.75%. Some Ohio counties fall into this lower-tax category, making them attractive for larger purchases if you’re willing to drive. You can verify your specific county’s rate by checking the Ohio Department of Taxation website or asking your local tax authority.

What’s Actually Taxed in Ohio

Not everything you buy in Ohio is subject to sales tax—understanding the exemptions can save you real money. Ohio taxes most tangible personal property, including:

- Clothing and accessories

- Electronics and appliances

- Furniture and home goods

- Books and printed materials (with exceptions)

- Restaurant meals and prepared foods

- Gasoline and fuel

- Cosmetics and toiletries

However, several categories are exempt from Ohio sales tax, which is important to know. Services like haircuts, legal advice, medical care, and repairs are generally not taxed. This is a key difference from tangible goods—you’ll pay tax on a new shirt, but not on the tailor’s fee to alter it.

Combined Tax Rate Examples

Let’s make this practical. If you’re buying a $100 item in different Ohio locations, here’s what you’d actually pay:

- Columbus (Franklin County): $100 × 7.5% = $107.50

- Cleveland (Cuyahoga County): $100 × 8% = $108.00

- Cincinnati (Hamilton County): $100 × 7.5% = $107.50

- A county with 5.75% only: $100 × 5.75% = $105.75

On a $500 purchase, that difference between 5.75% and 8% amounts to $11.25—hardly chump change. For big-ticket items like furniture or appliances, the difference becomes even more significant. This is why savvy shoppers sometimes plan purchases strategically across county lines for major buys.

Food and Groceries Exception

Here’s one of Ohio’s best-kept tax secrets: unprepared food items are not subject to sales tax. This means your grocery store purchases—raw vegetables, meat, dairy, bread, and canned goods—are all tax-free. This is a significant savings compared to states that tax groceries.

The distinction is crucial: unprepared food (what you cook at home) is exempt, but prepared or ready-to-eat food is taxed. So your deli chicken breast is tax-free, but the rotisserie chicken from the hot case is taxable. Soda and candy are also taxed, as they’re considered non-essential food items. This policy recognizes that basic nutrition shouldn’t be burdened with tax, which helps lower-income families stretch their food budgets.

Vehicle Sales Tax Rules

If you’re buying a car in Ohio, the sales tax applies to the purchase price. You’ll pay your county’s combined sales tax rate on the vehicle, which can amount to hundreds or even thousands of dollars on a new car purchase.

Here’s what’s important: if you’re buying a used vehicle from a private party (not a dealer), you’ll still owe sales tax when you register it with the Ohio Bureau of Motor Vehicles. You can’t avoid the tax by going the private-party route. However, if you’re trading in a vehicle, you only pay tax on the net amount (the difference between the new vehicle’s price and your trade-in value). This trade-in credit can meaningfully reduce your tax burden. Like other states’ car tax structures, understanding this helps you budget for that new vehicle purchase.

Online Shopping and Remote Sales

As an Ohio resident, you might think online purchases are tax-free—but that’s increasingly not the case. Following the 2018 Supreme Court decision in South Dakota v. Wayfair, online retailers are now required to collect and remit sales tax on purchases shipped to Ohio, even if the seller has no physical presence in the state.

This means Amazon, eBay, Walmart.com, and virtually all major online retailers now charge Ohio sales tax at checkout. The rate applied is typically based on your delivery address, so you’ll pay your local combined rate. If you’re comparing prices between online and in-store purchases, factor in that sales tax—the online price advantage has largely disappeared for Ohio shoppers.

One exception: some small sellers with annual revenues under $100,000 may not be required to collect tax, but most established retailers do. When in doubt, check whether tax is added at checkout before completing your purchase.

Back-to-School Tax Holidays

Ohio offers a back-to-school sales tax holiday that typically runs for a few days in early August. During this period, qualifying school supplies, clothing, and footwear are purchased tax-free. This is a genuine money-saver if you’re buying items for students.

Qualifying items typically include:

- School supplies (pens, notebooks, calculators)

- Clothing and shoes under certain price thresholds

- Computer equipment for educational use

Items that don’t qualify include sports equipment, jewelry, and items over specific price limits. The tax holiday dates and specific rules change annually, so check the Ohio Department of Taxation website before back-to-school shopping season. Families with multiple kids can save $50-$150+ during this tax-free period, making it worth planning your shopping strategically.

Frequently Asked Questions

Is Ohio’s sales tax rate the same everywhere in the state?

No. Ohio’s state rate is 5.75%, but counties and municipalities add local taxes ranging from 0% to 2.25%. Your total rate depends on where you shop. For comparison, sales tax in Las Vegas and Massachusetts sales tax work similarly with local variations.

Do I pay sales tax on groceries in Ohio?

Unprepared groceries are tax-free in Ohio. Items you cook at home—produce, meat, dairy, and bread—are exempt. However, prepared foods, restaurant meals, soda, and candy are taxed at your local rate.

What about used items and secondhand purchases?

Sales tax applies to used goods sold by retailers, just like new items. However, if you’re selling items privately (like a garage sale), sales tax typically doesn’t apply to those transactions. When you buy from a used goods store or pawn shop, expect to pay tax.

Do I need to pay sales tax on services?

Most services are not subject to Ohio sales tax. Haircuts, medical care, legal advice, and repairs are generally tax-free. However, certain services like pest control and some repair services may be taxed depending on specifics. When in doubt, ask the service provider.

How do I know my exact local sales tax rate?

Visit the Ohio Department of Taxation website or use their sales tax lookup tool. You can also call your county auditor’s office or ask at any local business. Knowing your exact rate helps with budgeting and price comparisons.

Are there other Ohio sales tax exemptions I should know about?

Yes. Prescription medications are exempt, as are certain medical devices and equipment. Agricultural equipment used by farmers is also exempt. Non-profit organizations may qualify for exemptions on certain purchases. Check with the Ohio Department of Taxation for a complete list.

Final Thoughts

Understanding how much is sales tax in Ohio is more than just knowing the state’s 5.75% rate—it’s recognizing that your actual tax burden depends on your county, what you’re buying, and where you’re shopping. Whether you’re a resident planning major purchases or a business owner calculating costs, these nuances matter.

The good news? Ohio’s grocery exemption and back-to-school tax holiday provide meaningful savings opportunities. The state also doesn’t tax most services, which helps keep certain costs down. For major purchases, knowing your county’s combined rate and comparing it to neighboring counties can result in real savings. And if you’re shopping online, remember that sales tax now applies—the days of tax-free internet shopping in Ohio are long gone.

For the most current rates and exemptions, always check the Ohio Department of Taxation website. Tax laws change, and staying informed ensures you’re making smart financial decisions. If you’re comparing Ohio’s tax structure to other states, you might also want to review Oakland sales tax, Irvine CA sales tax, or Arkansas car sales tax rates to see how Ohio stacks up.