If you’re shopping, running a business, or moving to Irvine CA sales tax territory, you need to know exactly what you’ll pay at checkout. The combined sales tax rate in Irvine, California is 7.75% as of 2024, but understanding where that number comes from—and how it affects your wallet—is what separates informed buyers from surprised ones.

Table of Contents

Current Irvine Sales Tax Rate 2024

The combined sales tax rate in Irvine is 7.75%. This applies to most retail purchases within city limits. However, this single number masks a layered system. You’re actually paying three separate taxes rolled into one:

- State of California: 6.00%

- Orange County: 1.00%

- Irvine City: 0.75%

That’s why when you buy a $100 item in Irvine, you’re not paying $100—you’re paying $107.75. The difference between what you see on the price tag and what you pay at checkout is real money leaving your pocket. For businesses, this means tracking and remitting multiple tax jurisdictions to different agencies, which is why many hire accountants or use specialized software.

Tax Rate Breakdown & Components

Understanding the layers of Irvine’s sales tax helps you see why California is known for high sales taxes. The state collects 6% across the board, but then local jurisdictions add their own cuts. Orange County adds 1%, and Irvine piles on an additional 0.75% for city services.

This structure means Irvine’s combined rate is higher than the statewide average of 7.25%, but lower than some California cities. For comparison, check out our Orange County Sales Tax Rate guide for how Irvine stacks up against neighboring areas.

The city’s 0.75% portion funds local infrastructure, public safety, and services. When you understand that your sales tax dollars support local schools and roads, it’s easier to accept the hit at checkout—though it doesn’t make your receipt any smaller.

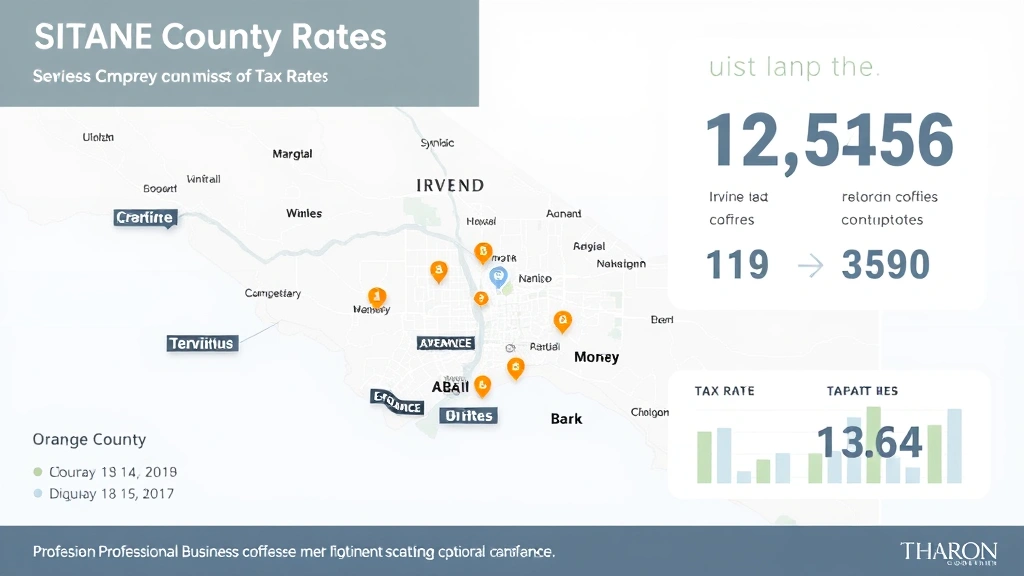

Orange County Sales Tax Context

Irvine sits in Orange County, one of California’s most affluent and tax-conscious regions. The county’s 1% addition to the state rate is relatively modest compared to other California counties, but it’s still substantial when you’re buying a car, furniture, or electronics.

Orange County residents often compare their tax burden to neighboring San Diego County (7.25%) and Los Angeles County (9.5%), which helps put Irvine’s 7.75% in perspective. You’re not in the worst position tax-wise, but you’re definitely not in the best either. For detailed Orange County context, our Orange County Sales Tax Rate breakdown provides a full county-wide comparison.

If you’re considering a major purchase, knowing the tax rate in surrounding areas might save you money. Some savvy shoppers time big buys to visit lower-tax jurisdictions, though the savings need to outweigh travel time and effort.

What’s Actually Taxed in Irvine

Not everything you buy in Irvine gets hit with the 7.75% rate. California has specific exemptions and special rules that matter for your budget:

- Groceries & Food: Generally exempt from sales tax (though prepared foods and restaurant meals are taxed)

- Prescription Medications: Exempt

- Medical Devices: Most are exempt, but this gets complicated

- Vehicles: Taxed, and California’s rate is steep—see our Sales Tax on a Car guide for comparison

- Services: Most services are NOT taxed (haircuts, plumbing, consulting)

- Clothing Under $110: Exempt (California’s clothing exemption is generous)

The clothing exemption is one California quirk that actually helps consumers. If you buy a $100 shirt, no sales tax. But buy a $150 shirt? Full 7.75% applies to the entire amount. This creates odd incentives around the $110 threshold.

Business Implications & Compliance

If you own a business in Irvine, sales tax compliance isn’t optional—it’s mandatory and the penalties for getting it wrong are steep. You must collect 7.75% on taxable sales and remit it to the California Department of Tax and Fee Administration (CDTFA).

Here’s what business owners need to handle:

- Sales Tax Permit: Required before opening

- Collection: You’re responsible for collecting the correct amount

- Remittance: Due monthly, quarterly, or annually depending on your sales volume

- Record Keeping: The CDTFA can audit you for up to four years

- Nexus Rules: If you have customers outside Irvine, you may owe sales tax in multiple jurisdictions

Many Irvine businesses use point-of-sale systems that automatically calculate sales tax, reducing errors. For online businesses or those with remote customers, the rules get complicated fast. Our State of California Online Tax Payment resource covers digital filing requirements.

Online Purchases & Remote Sales

The sales tax landscape changed dramatically when the Supreme Court ruled in South Dakota v. Wayfair (2018) that online sellers must collect sales tax even without a physical presence in the state. This means when you order from Amazon, Etsy, or any online retailer, they’re likely collecting Irvine’s 7.75% rate.

However, enforcement is inconsistent. Some smaller online sellers still don’t collect California sales tax, which creates a gray area. If you’re buying online and sales tax wasn’t collected, California technically expects you to pay “use tax” on your return—though most individuals don’t.

For businesses selling online, this is critical: you need to know your nexus in California. Do you have customers in Irvine? You probably owe sales tax. Do you have a warehouse, employees, or office in California? Definitely owe sales tax. The complexity here is why many online sellers hire tax professionals.

Recent Changes & Future Outlook

California’s sales tax landscape is constantly shifting. Recent changes affecting Irvine include:

- Digital Goods: California expanded what counts as taxable digital goods, affecting software and app purchases

- Cannabis Sales Tax: Added on top of regular sales tax (reaching 45%+ when combined with state excise tax)

- Remote Seller Enforcement: The CDTFA has become more aggressive about collecting from online retailers

Looking ahead, California legislators periodically propose sales tax increases to fund specific initiatives. While no major changes to Irvine’s rate are imminent, the state’s budget pressures mean tax increases are always possible. If you’re making a major business decision in Irvine, assume taxes could go up, not down.

Tax Planning Strategies

While you can’t avoid sales tax entirely, smart planning can minimize its impact:

- Bulk Purchases: Buy exempt items (groceries, medications) in bulk to reduce taxable transaction frequency

- Business Use: If you’re a business owner, resale certificates let you buy inventory without paying sales tax upfront

- Timing Large Purchases: Some people time car or furniture buys to coincide with lower-tax-rate periods (though this is rare in California)

- Location Arbitrage: For major purchases, compare Irvine’s 7.75% to nearby areas, though this only makes sense for high-value items

- Tax Deductions: If you’re self-employed, track sales tax paid on business purchases—it may be deductible

The most practical strategy? Use tax-advantaged accounts (HSAs for medical expenses, 529s for education) to reduce the amount you spend on taxable goods in the first place. That $100 you don’t spend avoids all sales tax.

Frequently Asked Questions

What is the exact sales tax rate in Irvine, California?

The combined sales tax rate in Irvine is 7.75%, composed of 6% state tax, 1% Orange County tax, and 0.75% city tax. This rate applies to most retail purchases of tangible goods within Irvine city limits.

Do I pay sales tax on groceries in Irvine?

No. California exempts most groceries and unprepared foods from sales tax. However, prepared foods, restaurant meals, and hot foods are fully taxable. The line between “grocery” and “prepared food” can be unclear—when in doubt, assume it’s taxable.

Is sales tax the same throughout Orange County?

No. While the state (6%) and county (1%) portions are consistent, individual cities add their own local taxes. Irvine’s 0.75% is higher than some Orange County cities and lower than others. Check our Orange County Sales Tax Rate guide for specific city comparisons.

How do I calculate the final price of an item in Irvine?

Multiply the item price by 1.0775. For example: $100 × 1.0775 = $107.75. Most modern calculators and point-of-sale systems do this automatically.

Do online purchases to Irvine get charged sales tax?

Most legitimate online retailers now collect California sales tax, including the 7.75% rate for Irvine deliveries. However, some smaller sellers may not. If sales tax wasn’t collected, California technically requires you to pay “use tax,” though enforcement on individual purchases is rare.

Can I get a sales tax refund if I overpay?

Rarely. Sales tax refunds are available in very specific circumstances (like returned merchandise or qualifying business purchases). Contact the CDTFA directly if you believe you’ve overpaid.

How does Irvine’s sales tax compare to other California cities?

Irvine’s 7.75% is moderate for California. Los Angeles is 9.5%, San Francisco is 8.625%, and San Diego is 7.25%. You’re paying more than San Diego but less than LA or SF.

What happens if a business doesn’t collect sales tax in Irvine?

The CDTFA can assess back taxes, penalties, and interest. For egregious violations, criminal charges are possible. Most businesses use automated systems to ensure compliance.

Final Thoughts on Irvine Sales Tax

Understanding Irvine’s 7.75% sales tax rate is essential whether you’re a resident, business owner, or frequent shopper. The rate itself is straightforward, but the exemptions, compliance requirements, and planning opportunities are where the real value lies. Knowing what’s taxed and what isn’t—and how to structure purchases accordingly—can save you hundreds or thousands annually.

The key takeaway: sales tax is unavoidable in Irvine, but it’s not invisible. Every purchase is an opportunity to understand the true cost of living in Orange County. For businesses, compliance is non-negotiable and professional help often pays for itself through proper documentation and strategy.

If you’re navigating California’s broader tax landscape, remember that sales tax is just one piece. Property taxes, income taxes, and business taxes all interact. For comprehensive tax planning in Irvine, consider consulting a CPA familiar with both state and local requirements.