If you’re looking to maximize your tax savings on HVAC and heating equipment purchases, Lennox 2025 tax credit certificates could put hundreds—or even thousands—back in your pocket. As a CPA who’s helped countless homeowners navigate energy efficiency incentives, I can tell you that most people leave money on the table simply because they don’t know these credits exist. Let’s change that.

Table of Contents

What Are Lennox Tax Credits?

Lennox 2025 tax credit certificates are federal tax incentives designed to encourage homeowners to invest in high-efficiency heating and cooling systems. These aren’t rebates—they’re direct tax credits that reduce your actual tax liability dollar-for-dollar. The difference matters: a $500 credit saves you $500 in taxes, while a $500 rebate might only reduce your equipment cost.

The IRS has structured these credits to make upgrading your HVAC system more affordable. When you purchase a qualifying Lennox system and claim the credit on your tax return, you’re essentially getting the government to subsidize part of your energy efficiency upgrade. Think of it as a financial incentive to reduce your home’s carbon footprint while lowering your monthly utility bills.

Eligibility Requirements Explained

Not every Lennox system qualifies, and not every homeowner can claim the credit. Here’s what you need to know:

Property Requirements: Your primary residence must be located in the United States. Second homes and rental properties typically don’t qualify, though there are limited exceptions for certain energy-efficient improvements on rental units.

Equipment Standards: Your Lennox system must meet specific SEER2 (Seasonal Energy Efficiency Ratio) ratings established by the Department of Energy. For 2025, most air conditioning units need to achieve SEER2 ratings of 16 or higher, while heat pumps must meet HSPF2 (Heating Seasonal Performance Factor) minimums of 8.5 or better.

Installation Timing: The equipment must be placed in service during the 2025 tax year. This means it needs to be installed and operational before December 31, 2025. Simply purchasing the equipment doesn’t count—it has to be working in your home.

Income Limits: Unlike some tax credits, Lennox 2025 tax credit certificates don’t have income phase-outs at the federal level, but some state programs do. Check your state’s specific rules.

Credit Amounts for 2025

The 2025 credit structure rewards you for choosing the most efficient equipment available. Here’s the breakdown:

Air Conditioning Systems: If you install a qualifying air conditioner with a SEER2 rating of 16 or higher, you can claim a credit of up to $300. Systems rated 17+ SEER2 qualify for the same $300 credit.

Heat Pumps: These are where the bigger savings live. A qualifying heat pump with an HSPF2 rating of 8.5 or higher earns you a $2,000 credit. This is substantial and reflects the government’s push toward electrification and heat pump adoption. If your heat pump also qualifies as a cold-climate heat pump (HSPF2 of 8.5+), you might access additional state credits.

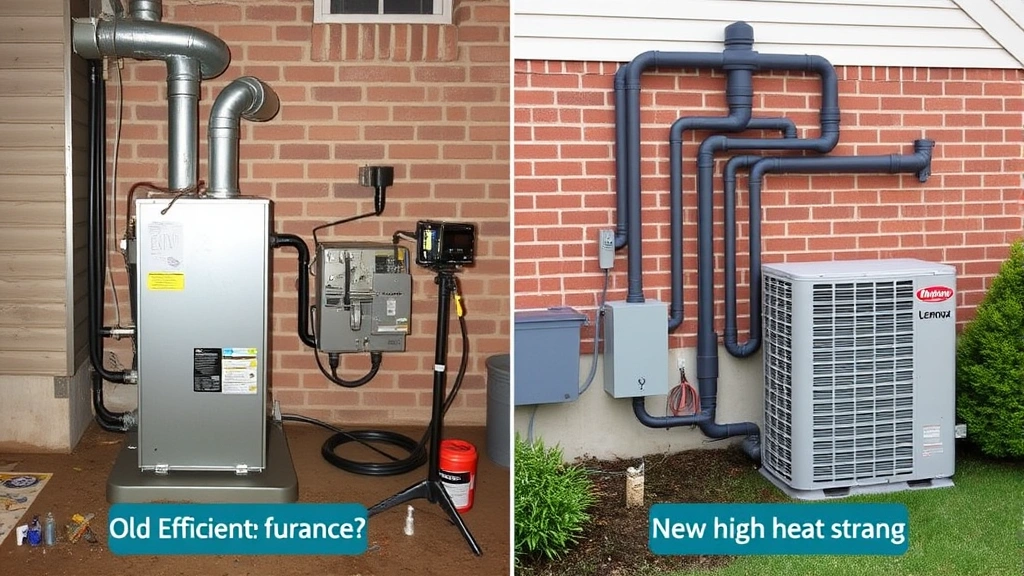

Furnaces and Boilers: High-efficiency furnaces (95%+ AFUE) and boilers (95%+ AFUE) qualify for $600 credits each.

Water Heaters: Heat pump water heaters with an energy factor of 2.0 or higher qualify for a $300 credit.

You can claim credits for multiple systems in a single year. For example, if you install both a heat pump and a high-efficiency furnace, you could claim both credits on your 2025 tax return.

How to Claim Your Credits

The claiming process is straightforward if you have proper documentation. Here’s the step-by-step approach:

Step 1: Gather Your Equipment Documentation Your Lennox dealer should provide you with a certificate or documentation showing the model number, SEER2/HSPF2 rating, and installation date. Keep this safe—you’ll need it for your tax return.

Step 2: Complete IRS Form 5695 This is the official form for residential energy credits. Section I covers the Lennox equipment you installed. You’ll need to list the type of equipment, the cost, and the date it was placed in service.

Step 3: File with Your Tax Return Attach Form 5695 to your Form 1040 when you file your federal income tax return. If you’re working with a tax professional, provide them with all equipment documentation upfront.

Step 4: Claim the Credit Transfer the credit amount from Form 5695 to your Form 1040. This directly reduces your tax liability.

Pro tip: If you’re claiming multiple energy efficiency credits—like solar panels or insulation improvements—they all go on Form 5695. This is where many people get confused, so take your time with this form or work with a tax professional.

Energy Efficiency Tax Benefits

Beyond the immediate tax credits, Lennox 2025 tax credit certificates are part of a broader ecosystem of energy efficiency incentives. Understanding this landscape helps you maximize your total savings.

The Inflation Reduction Act expanded these credits significantly starting in 2023, and they continue through 2025 with full value. Unlike previous years when credits phased down, the 2025 amounts remain robust. This is your window to claim substantial credits before potential future reductions.

Many states also offer additional rebates on top of federal credits. For example, some states provide an extra $500-$1,000 rebate for heat pump installations. These stack with your federal credit, so a $2,000 federal credit plus a $1,000 state rebate means $3,000 in total incentives.

Your utility company might also offer rebates. Check with your local electric and gas providers—many have programs specifically for high-efficiency HVAC upgrades. These typically don’t affect your ability to claim federal tax credits.

Common Mistakes to Avoid

I’ve seen homeowners miss out on thousands because of preventable errors. Don’t be one of them:

Mistake 1: Claiming Credits on Old Equipment If you installed your Lennox system in 2024 or earlier, you can’t claim it in 2025. Each credit must be claimed in the year the equipment is placed in service. Some people try to “catch up” on old installations and get flagged by the IRS.

Mistake 2: Not Verifying SEER2 Ratings Just because something says “Lennox” doesn’t mean it qualifies. You must verify the actual SEER2 or HSPF2 rating. Some older or lower-end models don’t meet the thresholds. Your dealer should confirm this before installation.

Mistake 3: Forgetting to Document Installation Date The IRS cares about when the equipment was placed in service, not when you purchased it. If you buy in December but don’t install until January, the credit belongs to the following year. Get written confirmation of your installation date.

Mistake 4: Missing the Deadline You must file your tax return (or request an extension) by the April deadline to claim 2025 credits. Unlike some tax breaks, energy credits don’t carry forward indefinitely if you miss the year.

Mistake 5: Mixing Up Rebates and Credits If your dealer offers a rebate, that typically reduces your equipment cost but doesn’t affect your tax credit. However, if you use a federal rebate program that the IRS specifically designates, it might reduce your credit basis. Ask your dealer to clarify which type of incentive they’re offering.

Documentation You’ll Need

The IRS doesn’t require you to attach documents to your return, but you must keep them for your records in case of an audit. Here’s what to preserve:

- Invoice or Receipt: Shows the equipment cost and purchase date

- Installation Certificate: Provided by your Lennox dealer, showing model number, efficiency rating, and installation date

- Proof of Payment: Credit card statement, bank transfer, or cancelled check

- Contractor License: Some states require that a licensed contractor install the equipment. Keep proof of this

- Utility Connection Documents: For some credits, you need proof the equipment is connected to your primary residence

- Warranty Information: Often includes the SEER2/HSPF2 rating and confirms the equipment type

Organize these documents in a folder labeled with the year. Digital copies are fine, but make sure they’re legible. I recommend keeping originals for at least 7 years (the IRS audit period).

Important Deadlines

Timing matters with tax credits. Here are the critical dates:

Installation Deadline: December 31, 2025. Your Lennox system must be fully installed and operational by this date to qualify for the 2025 credit.

Tax Filing Deadline: April 15, 2026 (or October 15, 2026 if you file an extension). You must claim the credit on your 2025 tax return filed by this date.

Documentation Retention: Keep all records for at least 7 years from the filing date.

If you’re planning an HVAC upgrade, don’t wait until November or December. Installation companies get slammed in the fall, and you risk missing the deadline if there are delays. Plan your installation for spring or summer when contractors have more availability and can guarantee completion before year-end.

Frequently Asked Questions

Can I claim Lennox 2025 tax credit certificates for a second home?

No. Federal tax credits for residential energy efficiency are limited to your primary residence. Second homes, vacation properties, and investment properties don’t qualify under the standard rules. However, some states offer separate incentive programs for rental properties—check your state’s energy office.

What if I don’t owe taxes? Can I get a refund?

This depends on the specific credit structure. Some energy credits are non-refundable, meaning they can only reduce your tax liability to zero. If your credit exceeds your tax liability, you lose the excess. However, some credits can be carried forward to future years. Consult with a tax professional to understand how this applies to your situation, as rules changed with recent legislation.

Do I need to file Form 5695 even if I don’t owe taxes?

Yes. You must file Form 5695 with your tax return to claim the credit, even if your overall tax liability is zero. This documents the credit for IRS records.

Can my contractor claim the credit instead of me?

No. Only the homeowner can claim residential energy credits. Contractors cannot claim these credits on behalf of customers. However, contractors sometimes offer rebates (which they fund themselves) in addition to your federal credit.

What’s the difference between Lennox 2025 tax credit certificates and manufacturer rebates?

Tax credits are federal incentives claimed on your tax return and reduce your tax liability. Manufacturer rebates are discounts on the equipment cost offered by Lennox or dealers. You can typically claim both. The rebate reduces your out-of-pocket cost, and the tax credit reduces your taxes. They don’t interfere with each other.

If I claim the credit in 2025, can I claim it again in 2026 for the same equipment?

No. Each piece of equipment can only generate one credit claim. Once you claim it for 2025, you cannot claim it again. However, if you install different equipment in 2026, you can claim a separate credit for that equipment on your 2026 return.

Are there income limits for Lennox 2025 tax credit certificates?

At the federal level, no. The credit is available regardless of income. However, some state programs do have income limits. Check your state’s specific program rules. Additionally, if you have very high income, certain phase-out rules might apply to other credits on your return, but not to these energy credits specifically.

What if my contractor didn’t provide documentation of the SEER2 rating?

Contact your contractor immediately and request the equipment specification sheet or installation certificate showing the SEER2/HSPF2 rating. If they can’t provide it, you can look up the model number on Lennox’s website or contact Lennox directly. You need this documentation to claim the credit accurately.

Final Thoughts on Maximizing Your Savings

Lennox 2025 tax credit certificates represent real money back in your pocket—money that the federal government is essentially offering to encourage energy-efficient home upgrades. A $2,000 heat pump credit can offset 20-30% of your equipment cost, making a high-efficiency system far more affordable.

The key to success is planning ahead. Don’t wait until December to schedule your installation. Gather your documentation carefully. File your tax return accurately. And if you’re uncertain about anything, work with a tax professional who understands energy credits—it’s worth the investment.

If you’re also exploring other tax-saving opportunities, you might want to review SETC tax credits if you’re self-employed, or check out tax card updates for 2025-26 to understand your overall tax picture. And if you own rental property, don’t forget about rental property tax deductions that might apply to energy-efficient upgrades on those properties.

The bottom line: Lennox 2025 tax credit certificates are a legitimate, government-backed way to reduce the cost of upgrading your home’s heating and cooling system. Take advantage of them before the credits potentially decrease or expire.