Understanding Oklahoma vehicle sales tax is essential if you’re buying a car in the Sooner State. Whether you’re a first-time buyer or trading in your current vehicle, knowing the tax rates, exemptions, and filing requirements can save you hundreds of dollars. In this guide, we’ll walk you through everything you need to know about vehicle sales tax in Oklahoma, including how it’s calculated, what you can deduct, and strategies to minimize your tax burden.

Table of Contents

Current Oklahoma Sales Tax Rates

Oklahoma’s state sales tax rate stands at 4.5% on vehicle purchases. However, this isn’t the complete picture. Many Oklahoma counties and municipalities add their own local sales taxes on top of the state rate, bringing your total tax burden anywhere from 4.5% to 11.5% depending on your location. For example, if you’re buying in Oklahoma County (which includes Oklahoma City), you’ll pay approximately 8.625% in combined sales tax. The Tulsa area carries a similar rate around 8.725%.

It’s crucial to know your specific local rate before making a purchase. You can verify this by checking with your county assessor’s office or using the Oklahoma Tax Commission’s online resources. This knowledge allows you to budget accurately and understand exactly what you’ll pay at the point of sale.

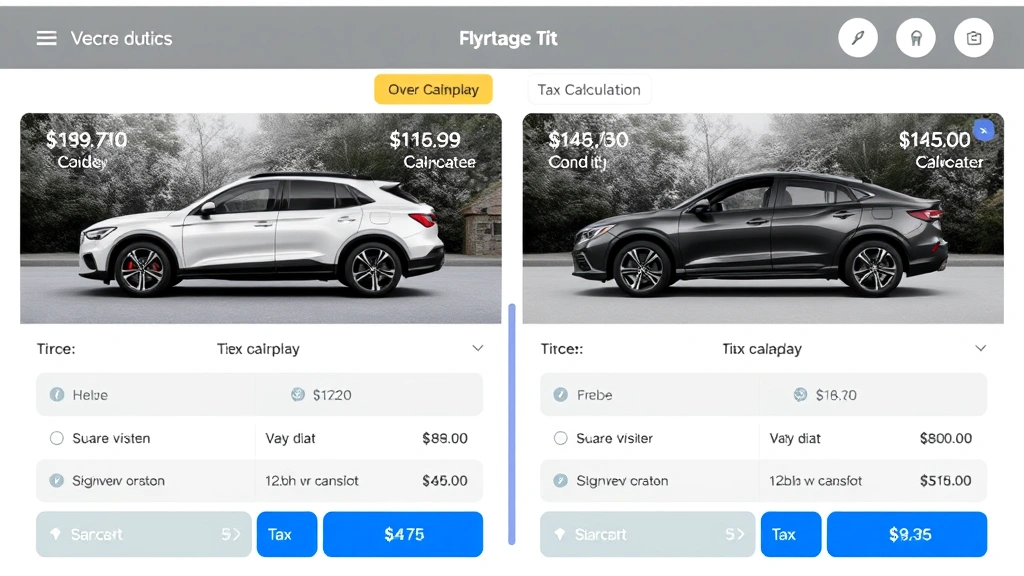

How Vehicle Sales Tax Is Calculated

The calculation for Oklahoma vehicle sales tax is straightforward: multiply the vehicle’s purchase price by your applicable tax rate. Here’s a practical example: if you buy a car for $25,000 in an area with an 8.625% combined tax rate, you’ll owe $2,156.25 in sales tax. The dealership collects this tax at the time of purchase and remits it to the Oklahoma Tax Commission.

One important distinction: sales tax is calculated on the net purchase price, not the gross. This means if you’re trading in a vehicle, the trade-in value reduces the taxable amount. We’ll explore this benefit in detail below. Additionally, if you’re financing the vehicle, the sales tax can typically be rolled into your loan, though you’ll pay interest on this amount over time.

Trade-In Vehicle Credit Benefits

One of the most significant money-saving opportunities in Oklahoma is the trade-in credit. When you trade in your current vehicle toward a new purchase, you only pay sales tax on the difference between the new car’s price and your trade-in value. This is sometimes called the “net purchase price” method.

Let’s illustrate with an example: You’re buying a $30,000 vehicle and trading in your old car valued at $8,000. Instead of paying tax on the full $30,000, you pay tax only on $22,000. At an 8.625% rate, that’s a savings of $690 compared to paying tax on the full purchase price. This benefit applies whether you’re buying from a dealer or in a private sale (though private sales have different rules—see below).

Pro tip: Get your trade-in vehicle appraised independently before heading to the dealership. Knowing its fair market value gives you negotiating power and ensures you’re getting the maximum credit possible.

Exemptions and Deductions Available

Oklahoma offers several exemptions and deductions that can reduce your vehicle sales tax liability. Business vehicles used primarily for commercial purposes may qualify for exemptions under certain circumstances. If you’re purchasing a vehicle for your business, consult with a tax professional or the Oklahoma Tax Commission to determine eligibility.

Additionally, vehicles purchased by non-profit organizations or government entities may be exempt from sales tax. If you fall into one of these categories, you’ll need to provide documentation proving your status at the time of purchase. The dealership won’t automatically apply these exemptions—you must claim them and provide proper paperwork.

Another consideration: if you’re buying a vehicle out-of-state and bringing it to Oklahoma, you may owe “use tax” instead of sales tax. Use tax is Oklahoma’s way of collecting tax on purchases made elsewhere. The rate is identical to sales tax, and you typically pay it when you register the vehicle in Oklahoma.

Registration Fees and Taxes

Beyond sales tax, Oklahoma charges registration fees that you’ll need to factor into your total vehicle cost. Annual registration fees vary based on the vehicle’s age, type, and weight. For a new vehicle, expect to pay between $75 and $150 for initial registration, depending on these factors.

Oklahoma also charges a one-time title fee of approximately $11 when you purchase a vehicle. This is separate from sales tax but is a mandatory cost. If you’re financing the vehicle, your lender will likely handle title and registration as part of the loan process, but these costs will still be your responsibility.

Don’t overlook these fees when budgeting for your vehicle purchase. While they’re smaller than sales tax, they add up quickly. A $25,000 vehicle purchase might include $2,000+ in sales tax, plus $100-150 in registration fees, plus the title fee. Understanding the complete cost picture prevents sticker shock at closing.

Private Party Vehicle Sales

Buying a vehicle from a private party in Oklahoma has different tax implications than buying from a dealer. When purchasing from an individual, you’re still responsible for paying sales tax, but the rules around trade-ins and who collects the tax differ.

In private sales, you must pay sales tax when you register the vehicle with the Oklahoma Tax Commission. The tax is calculated on the purchase price you paid for the vehicle, minus any trade-in credit if applicable. You cannot simply avoid paying tax by purchasing privately—Oklahoma’s use tax ensures the state collects revenue regardless of the sale method.

To complete a private party purchase in Oklahoma, you’ll need the seller’s title certificate, a bill of sale, and proof of identification. When you visit the Tax Commission office or authorized agent to register the vehicle, you’ll pay the applicable sales/use tax at that time. This process protects both buyer and seller by creating an official record of the transaction.

Timing Strategies to Save Money

Strategic timing of your vehicle purchase can yield meaningful tax savings. If you’re considering buying near a state or local tax rate change, research whether rates are increasing or decreasing. While Oklahoma doesn’t frequently adjust state rates, some municipalities do adjust local rates periodically.

Another timing consideration: end-of-month and end-of-quarter sales events often feature dealer incentives that reduce the vehicle’s final price. Since sales tax is calculated on the purchase price, a lower negotiated price directly reduces your tax liability. A $2,000 price reduction saves you approximately $172 in tax (at 8.625%), making negotiation worthwhile.

Additionally, some dealers offer rebates or incentives that can be applied to reduce the purchase price. Unlike dealer financing incentives, price-reduction incentives directly lower your taxable amount. Always ask dealers to clearly separate price reductions from financing incentives so you understand the tax implications.

Dealer Responsibilities and Documentation

Oklahoma law requires licensed dealers to collect sales tax at the point of sale and remit it to the Oklahoma Tax Commission. Reputable dealers provide you with documentation showing the purchase price, trade-in credit (if applicable), the taxable amount, and the sales tax collected. This documentation is essential for your records.

When reviewing dealer paperwork, verify that trade-in credits were properly applied to reduce your taxable amount. Mistakes happen, and catching errors before you leave the dealership is far easier than disputing them later. The sales contract should clearly itemize all charges, including sales tax, registration fees, and title fees.

If you’re purchasing through financing, your lender will also receive copies of this documentation. The sales tax amount will typically be included in your loan amount, meaning you’ll pay interest on it over the life of the loan. Understanding this cost helps you evaluate whether rolling tax into your loan makes financial sense compared to paying it upfront.

Frequently Asked Questions

What is Oklahoma’s vehicle sales tax rate?

Oklahoma’s state sales tax on vehicles is 4.5%, but combined with local taxes, the total rate ranges from 4.5% to 11.5% depending on your county and municipality. Check with your local tax assessor to determine your specific rate.

Can I avoid paying sales tax on a vehicle purchase?

No, Oklahoma requires sales tax on all vehicle purchases, whether from dealers or private parties. However, you can minimize your tax liability through trade-in credits, timing your purchase strategically, and negotiating the lowest possible purchase price.

How does trade-in credit reduce my tax burden?

When you trade in a vehicle, sales tax applies only to the difference between the new vehicle’s price and the trade-in value. For example, buying a $30,000 car with an $8,000 trade-in means paying tax on $22,000 instead of $30,000, saving hundreds in taxes.

Do I pay sales tax on private party vehicle purchases?

Yes, you pay sales tax on private party purchases when you register the vehicle with the Oklahoma Tax Commission. The tax rate is identical to dealer sales, and you cannot avoid this requirement by purchasing privately.

What fees beyond sales tax should I expect?

Beyond sales tax, expect to pay a title fee (approximately $11), annual registration fees ($75-150 for new vehicles), and potentially documentation fees charged by dealers. These vary based on vehicle type and age.

Can I deduct vehicle sales tax on my federal income tax?

Generally, no. Federal tax law eliminated the deduction for state and local sales taxes in 2017, with limited exceptions for those who itemize deductions. Consult a tax professional about your specific situation, as rules can be complex for business vehicles.

What documentation do I need for a private party sale?

You’ll need the seller’s title certificate, a bill of sale, proof of identification, and proof of insurance. When registering the vehicle, you’ll pay sales tax based on the purchase price stated in your bill of sale.

Are business vehicles taxed differently in Oklahoma?

Business vehicles may qualify for exemptions under certain circumstances. Consult with the Oklahoma Tax Commission or a tax professional to determine if your business vehicle qualifies for preferential treatment or exemptions.

Conclusion

Understanding Oklahoma vehicle sales tax empowers you to make informed purchasing decisions and minimize unnecessary costs. The state’s combined tax rates—ranging from 4.5% to 11.5% depending on location—represent a significant portion of your total vehicle purchase cost. By leveraging trade-in credits, strategically timing your purchase, negotiating aggressively on price, and understanding all applicable fees, you can save hundreds or even thousands of dollars.

Remember that sales tax applies to all vehicle purchases in Oklahoma, whether from dealers or private parties. The key is knowing your local tax rate, maximizing trade-in credits, and ensuring dealers properly document all charges. If you’re purchasing a business vehicle or have a unique situation, consulting with a tax professional ensures you’re taking advantage of every available deduction and exemption.

For comparison, you might also want to explore how vehicle sales tax works in neighboring states. For instance, check out our guides on car sales tax in North Carolina, sales tax in Pennsylvania on cars, and Missouri car sales tax loopholes to see how Oklahoma compares. Additionally, understanding general sales tax principles, like sales tax in Tennessee, provides helpful context for managing your overall tax liability.

Take time to calculate your specific tax liability before visiting a dealership. Use the Oklahoma Tax Commission’s resources and contact your local assessor’s office to confirm your area’s combined tax rate. With this knowledge, you’ll walk into negotiations confident and prepared to make the best financial decision for your vehicle purchase.