If you’re wondering which state has no property tax, the short answer is: there isn’t one. Every U.S. state levies some form of property tax, though rates vary dramatically—from under 0.3% in Hawaii to over 2% in New Jersey. But here’s what matters: some states have significantly lower property tax burdens than others, and understanding where those opportunities exist could save you tens of thousands of dollars over your lifetime. Let’s break down which states come closest to tax-free property ownership and what that actually means for your wallet.

Table of Contents

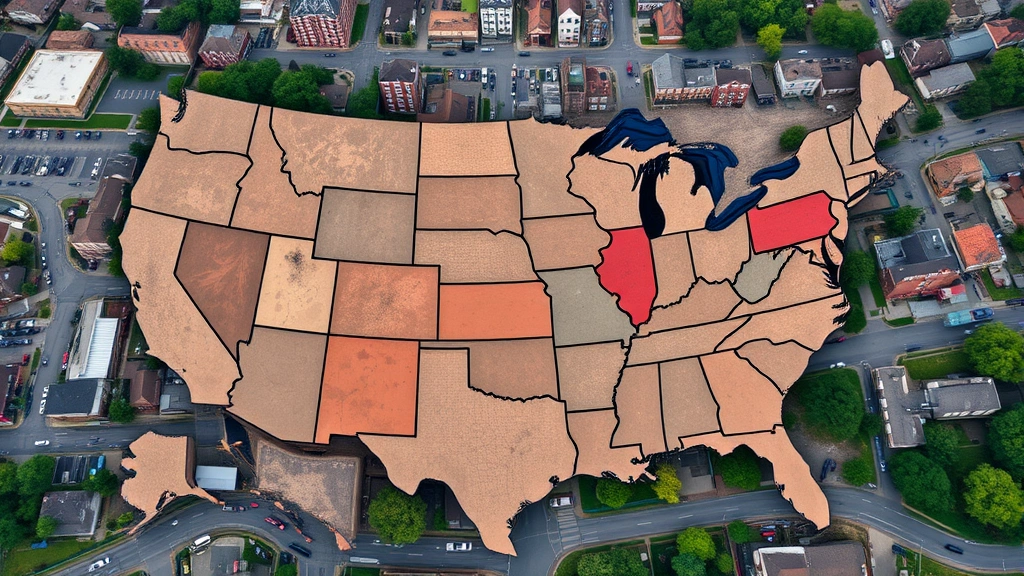

States With Lowest Property Tax Rates

Let me be direct: no state has eliminated property tax entirely. It’s a fundamental revenue source for local schools, roads, and emergency services. However, some states have made a deliberate policy choice to keep rates remarkably low. Hawaii leads the pack with an effective property tax rate of just 0.28%—meaning on a $500,000 home, you’d pay roughly $1,400 annually. Compare that to New Jersey’s 2.49% rate, where the same home costs $12,450 per year in property taxes alone.

The states clustering at the bottom of the property tax burden list include Hawaii, Alabama, Louisiana, and West Virginia. These aren’t accidents of policy—they reflect deliberate state and local decisions about how to fund government services. Some compensate with higher sales taxes or income taxes; others simply operate with leaner budgets.

Hawaii: The Closest Thing to Tax-Free

Hawaii’s 0.28% effective property tax rate is the lowest in America, and it’s worth understanding why. The state has a unique tax structure where property is assessed at only 50% of market value, then taxed at relatively modest rates. A homeowner in Honolulu pays significantly less in property taxes than someone with an identical home in most mainland states.

But here’s the catch: Hawaii compensates with a 4.0% state income tax (on top of federal), plus a 4.17% general excise tax that functions like a sales tax on nearly everything, including services. If you’re relocating to Hawaii for property tax savings while earning substantial income, you might find those gains evaporate. The equation only works if you’re retired, living off investment income taxed at preferential rates, or earning minimal wages.

Real estate in Hawaii is also among America’s most expensive. That 0.28% rate on a $1.2 million median home price still amounts to $3,360 annually—higher in absolute dollars than property taxes in many affordable mainland states.

Alabama and Louisiana: Underrated Alternatives

Alabama’s effective property tax rate of 0.41% deserves serious consideration, especially because the state has no income tax on retirement income—a massive advantage if you’re over 59½. Combined with reasonable home prices (median around $280,000), Alabama offers genuine affordability. A $300,000 home costs roughly $1,230 annually in property taxes.

Louisiana mirrors this advantage with a 0.55% effective rate and also exempts retirement income from state taxation. New Orleans and Baton Rouge offer cultural amenities and relatively affordable real estate. The trade-off: Louisiana has a 4.45% state income tax on wages, so this strategy works best for retirees.

Both states also offer homestead exemptions—additional property tax breaks for primary residences. Alabama’s homestead exemption can reduce taxable property value by $7,500, and Louisiana’s exemption covers the first $75,000 of home value. These add up quickly.

Other Genuinely Affordable States

If Hawaii, Alabama, or Louisiana don’t fit your situation, consider Mississippi (0.79%), Arkansas (0.62%), and Oklahoma (0.90%). All three have effective rates under 1%, plus they offer no income tax on retirement income. Mississippi’s median home price hovers around $230,000—combine that with minimal property taxes, and you’re looking at serious affordability.

Wyoming deserves mention as a unique case: no state income tax, no corporate income tax, and a 0.61% property tax rate. If you’re a business owner or high earner, Wyoming’s tax structure is genuinely attractive, though property values in desirable areas are rising quickly.

For those considering relocation, also evaluate Texas estate tax implications and whether your state of choice offers exemptions for your specific situation.

What Actually Affects Your Property Tax Bill

Here’s where most people get confused: state effective rates are averages. Your actual bill depends on three factors: the state rate, your county’s rate, and your local assessment practices.

A property in rural Alabama might have a 0.3% effective rate, while one in suburban Birmingham hits 0.7%. New Jersey’s state average is 2.49%, but some counties run 1.8% while others exceed 3%. Location within a state matters enormously—more than which state you choose.

Assessment practices also vary. Some counties assess property at 100% of market value; others use 50% or even lower. A $400,000 home assessed at 50% of value pays tax on only $200,000 of assessed value. This hidden factor can swing your bill by 30-50% even within the same state.

Your home’s classification also matters. Agricultural property, homesteads, and senior properties often receive preferential assessment rates. If you qualify for these classifications, your effective rate drops significantly below the county average.

The Sales Tax Trade-Off Reality

Here’s the uncomfortable truth: states with low property taxes almost always compensate elsewhere. Hawaii, which has the lowest property tax, has a 4.17% general excise tax plus income tax. Louisiana has low property taxes but a 4.45% income tax. This isn’t coincidence—it’s how states fund schools and services.

If you’re a heavy consumer or have substantial income, a state with low property tax but high income or sales tax might actually cost you more overall. A retiree living off Social Security and investment income (which may be tax-advantaged) benefits from low income taxes. A 45-year-old earning $150,000 annually might pay more total taxes in a low-property-tax state than in a state with higher property taxes but no income tax.

Calculate your actual tax burden across all categories before moving. Use state tax calculators or consult a CPA who understands multi-state taxation. The answer isn’t always obvious.

Income Tax Matters More Than You Think

For most working-age people, income tax dwarfs property tax. A professional earning $120,000 pays roughly $15,000-18,000 annually in federal income tax alone. State income tax could add another $3,000-8,000 depending on the state. Property taxes might run $1,500-3,000.

This is why states with no income tax—Texas, Florida, Tennessee, Wyoming—attract so many high earners, even though their property taxes aren’t the absolute lowest. Saving $4,000-6,000 annually in state income tax outweighs paying slightly higher property taxes.

If you’re considering a move for tax reasons, prioritize income tax savings first, property tax second. A state with 1.5% property tax but no income tax beats a state with 0.5% property tax and 5% income tax for most people.

Strategic Planning Before You Relocate

Moving for tax reasons requires serious analysis. Start by calculating your complete tax burden in your current state and your target state. Include federal, state income, property, sales, and any specialized taxes (inheritance, excise, etc.).

Consider also that establishing residency requires more than just buying a house. You need to demonstrate intent to remain: get a driver’s license, register vehicles, update voter registration, and maintain minimal in-state presence. Some states scrutinize relocations, especially if you’re a high earner moving from a high-tax state.

Timing matters too. If you’re selling a primary residence, you may qualify for capital gains exclusions that reduce your tax bill on the sale. If you own rental property or investment real estate, state-level tax treatment of passive income varies significantly. Review California property tax due dates and implications if you’re leaving a high-tax state, as you may have final obligations.

Don’t overlook lifestyle costs. A state with low taxes but high housing costs might not save you money overall. A state with low taxes but limited job opportunities might require sacrificing career growth. Tax optimization only works if the overall move makes sense for your life.

Frequently Asked Questions

Can I avoid property taxes entirely by moving to a specific state?

No. Every U.S. state levies property taxes. However, you can minimize them by choosing a low-rate state and, within that state, selecting a county with below-average rates. Combining this with homestead exemptions and preferential assessment classifications can reduce your effective rate significantly.

Is Hawaii really the best choice for property tax savings?

Only if you’re retired or have minimal income. Hawaii’s 0.28% property tax is offset by 4.0% income tax and 4.17% excise tax. For working professionals, states like Texas or Florida—with no income tax and moderate property taxes—often save more money overall.

Do retirement accounts get special property tax treatment?

No, but retirement income does in some states. Alabama, Louisiana, Mississippi, and Arkansas exempt retirement income (pensions, IRA distributions, Social Security in some cases) from state income tax. This creates powerful incentives for retirees to relocate there.

How do I verify a state’s actual property tax rate?

Check your state’s Department of Revenue website or use resources like the Tax Foundation’s annual property tax study. Remember: state averages hide significant county-level variation. Contact your target county’s assessor’s office for specific rates and assessment practices.

What’s the relationship between property taxes and school funding?

Property taxes fund roughly 45% of K-12 education nationally. States with low property taxes often have lower school funding per pupil, though this varies by state policies and reliance on sales or income taxes. Research school quality in your target area—it’s a major factor in home values and quality of life.

Can I deduct state property taxes on my federal return?

Yes, but with limitations. The SALT (State and Local Tax) deduction caps at $10,000 annually for most taxpayers. If you pay $8,000 in property taxes, you can deduct them. If you pay $12,000, you can only deduct $10,000 (accounting for other state and local taxes too). This cap reduced the value of property tax deductions for many high-income earners.

Final Thoughts: Location Matters, But Context Matters More

The answer to “which state has no property tax” is technically none—but that’s not the real question you should be asking. The real question is: “Which state minimizes my total tax burden while supporting my lifestyle?”

For retirees with pension income, Alabama or Louisiana might be perfect. For high-earning professionals, Texas or Florida could save you six figures over a decade. For families prioritizing school quality and community services, a higher-tax state might deliver better overall value.

Don’t chase tax savings alone. Evaluate housing costs, job opportunities, climate, proximity to family, healthcare quality, and lifestyle factors. A state that saves you $3,000 annually in taxes but costs you $50,000 more in housing prices is a bad deal.

If you’re seriously considering relocation, work with a CPA or tax advisor who understands multi-state taxation. They can model your specific situation and identify genuine opportunities. You might also explore property tax structures in specific counties to understand how local variations affect your bill. For complex situations, legal tax services can ensure your move is structured correctly for maximum tax efficiency.

The lowest property tax state isn’t necessarily the best choice for you. But understanding how property taxes work across states—and how they fit into your complete financial picture—absolutely is.